Happy New Year! I hope that you’ve had the opportunity to wind down, take things slowly and enjoy all the festivity with your family and friends. As we say goodbye to 2017, there were many great events that occurred during the last twelve months that were worth reviewing. I am extremely happy and excited to share all of it with you in this post.

What’s Covered In My Net Worth Review

If you have not started your personal net worth review for 2017 yet, I hope that this post will inspire you to get started. As usual, I’ll reflect on the following areas: net worth, real estate, debts, savings, and investments. However, the presentation of some of the categories had been re-ordered. I am still working on a format that will give this post a better flow to make it more readable and enjoyable for my readers. Let me know what your thoughts are in the comment section.

Why I Am Sharing My Net Worth Review

For new readers, the reason that I share my personal net worth review every quarter is to make myself accountable for my financial decisions. I want to encourage all my readers to take control of their personal finance and manage their money responsibly. I believe in transparency, accountability and knowledge sharing. If anyone has any questions, I encourage and welcome any inquiries in the comment section and I will try my best to address them.

What’s not my intent is to show off how much money I have or how great I am at managing my money. Please understand that everyone’s financial knowledge, motivation, risk tolerance and life situation is different. The actions that I had taken to improve my finances may or may not be suitable for everyone. The takeaway from my experience is to do whatever that makes sense to your personal situation not because someone else is doing it. So, without further ado, let’s get this net worth review started.

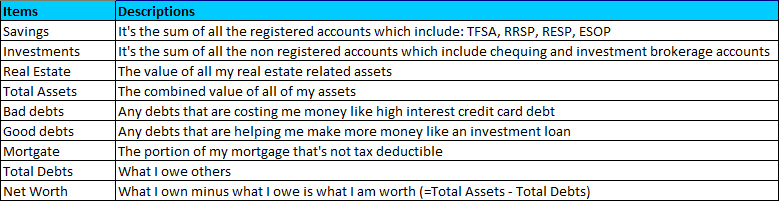

Table #1: The descriptions of items in my net worth review.

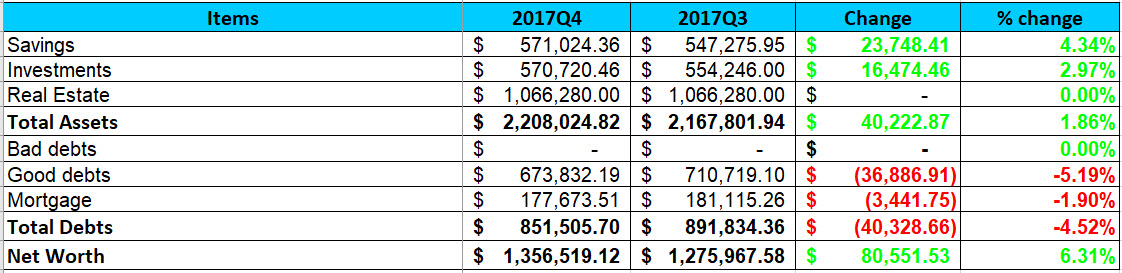

Table #2: 2017 Q4 Net Worth Performance

Net Worth Review

This quarter has been a great quarter. My investments had a reasonable return (+4.43%), my savings got a big boost due to the year-end bonus that both my wife and I got. We paid down $35K of debts and I have a separate post for this debt repayment to will share with you in an upcoming post. Overall, this quarter is the best performing quarter of the year with a net worth increase of $80,551.53 comparing to the first three quarters (Q1 = +71.539.72, Q2 = +19,644.08, Q3 = +23,335.78).

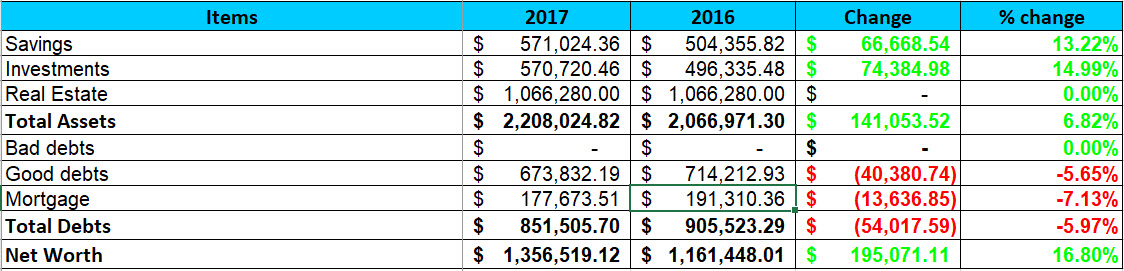

Table #3: 2017 Year-end Net Worth Performance

For the year, my net worth increased by an astounding $195,071.11 compared to 2016, but without any increases from real estate. I am really happy with this net worth increase as I surpassed three major net worth goals this year. The first was to increase my year-over-year net worth by $100,000. The second was to increase my net worth at a compounded annual rate of 10% (actual: +16.8%). Lastly, increasing my net worth to $1.3M (actual: $1,356,519.12). With such a stellar performance, this category deserves an “exceed expectation” rating.

Real Estate Review

The Canadian Real Estate market has constantly been in the headline the whole year. For the first three and a half months of the year, the Greater Toronto Area (GTA) home prices were increasing at an alarming and unsustainable rate. Resale and new construction homes were flying off the market like candies from a kid’s birthday party. Bidding wars were the norm in real estate transactions.

In late April, the Ontario Provincial government stepped in and introduced a foreign buyer tax for real estate transactions around the GTA. Any foreigner or non-permanent resident will fewer to a 15% foreign buyer tax when they purchase a property in the GTA. In a matter of weeks, the buyers went dormant, bidding wars were a rare sighting, sale prices and volumes trended down month after month.

Fortunately for me, I refused to overpay for a property back in the first quarter of the year when I was looking to invest in a new construction condo. I also stayed put in my home when the market was up for the first quarter of the year then down for the rest. Overall, the current market price of resale homes in my area is still about $100K above my estimate of my primary home. For this year, I am leaving the value of my real estate portfolio the same as last year. As a result, I am rating this category as a marginal “meet expectation.”

Debt Review

For most of the year, I did the absolute minimum with my debts. I was content to make only the required monthly payments for my mortgage and investment loan. I was on pace to pay off only about $18K in mortgage and investment loans for the whole year.

Due to an unforeseen circumstance, I needed to pay off an extra $35K in personal debt. Suddenly, I ended up paying off more than $54K in debts and lowered my overall debt level by 5.97%. I was fortunate enough to receive a year-end bonus and had some capital gains to offset. I sold a couple stocks to harvest the capital loss to offset the capital gains from my options activities, which I will cover later. The proceed of sale from those stocks were used to pay off the $35K in debt.

The sudden increase in debt payment demonstrated a simple, but important key to boost your net worth substantially. As you can see, a small percentage reduction in debt (-5.97%) and a modest increase in assets (+6.82%) compounded to create a sizeable increase in my net worth (+16.8%). When the trending of your debt (down) and asset (up) moves in the right directions, your net worth will be following a great trend too – up. Since the sudden debt payment was not part of my plan, I can’t take credit for this, so this category only deserves a “meet expectation” rating.

Savings Review

I have a confession. I made a rookie mistake and miscalculated our Registered Retirement Savings Plan (RRSP) contribution room earlier this year. I thought that we had $17,000 of RRSP contribution room this year and we do, but I forgot that my wife deferred last year’s bonus payment to earlier this year. Hence, we won’t be able to make the full $17,000 in RRSP contribution and had to stop at around $12,000.

| Items | Target | Amount Saved | Progress |

|---|---|---|---|

| RESP | $5,000.00 | $5,000.00 | 100% |

| RRSP | $17,000.00 | $12,000.00 | 70.59% |

| TFSA | $11,000.00 | $11,000.00 | 100% |

| Vacation Fund | $10,000.00 | $10,000.00 | 100% |

| Total Savings | N/A | $100,000.00 | N/A |

Table #4: My family saving goals for 2017

From the table above, three out of four of our family saving goals were completed by the end of the first quarter. I believe that when there’s free money available if we save, we should take full advantage of it as soon as possible. The earlier we get the free money working for us, the more time our savings has to grow. These are the reasons why we maxed our Tax Free Savings Account (TFSA) and Registered Education Savings Plan (RESP) accounts at the beginning of the year.

Only three of the four goals being completed was not a big deal. I went back to my net worth spreadsheet and did a quick estimate of our total savings. I realized that we saved almost $100K (excluding stock gains) this year. The good news was that we had a high saving rate. The bad news was our saving did about 50% of the heavy lifting to increase our net worth.

My preference is to have my savings contribute about 1/3 and my investments contribute about 2/3 of the increase in my net worth. As time goes by, I’d like my investments to account for the lion’s share of the increase in my net worth. Until then, I am happy to know that we were able to have a six-figure saving this year. As a result, this category deserves an “exceed expectation” rating.

Investments

Finally, we reached the investment section. I purposely leave this category last because I enjoy reviewing this category the most. If you had been reading my blog, you’ll notice that I have one very important money philosophy. “It’s not how much you earn, it’s how much you get to keep after taxes.” Every year, my goal is to pay the least amount of income tax as I possibly can, legally of course. So for this category, I will further break the review into sections: capital gains, dividends, interest costs and re-balancing, to discuss my strategies to keep more money in my pocket.

| Options – Contracts | Ticker | Expiry Date | Strike Price | Premium | Status | Return |

|---|---|---|---|---|---|---|

| Covered Call – 2 | CAT | January 19, 2018 | $110.00 | $628.00 | Active | -1,440.96% |

| Covered Call – 4 | EXR | September 15, 2017 | $85.00 | $685.03 | Expired | +100.00% |

| Covered Call – 4 | MCD | January 19, 2018 | $140.00 | $765.03 | Exercised | -1,435.08% |

| Covered Call – 5 | WFC | January 19, 2018 | $65.00 | $963.77 | Active | +90.97% |

| Naked Put – 3 | BMO | January 19, 2018 | $88.00 | $961.30 | Active | +97.81% |

| Naked Put – 1 | CMG | January 19, 2018 | $360.00 | $2,489.00 | Active | -161.15% |

| Naked Put – 3 | CNR | January 18, 2019 | $90.00 | $990.00 | Active | +31.17% |

| Naked Put – 5 | ENB | January 19, 2018 | $50.00 | $933.80 | Active | +34.76% |

| Naked Put – 1 | GOOG | January 18, 2019 | $600.00 | $789.00 | Active | +69.71% |

| Naked Put – 1 | GOOG | January 18, 2019 | $850.00 | $5,300.00 | Active | +70.17% |

| Naked Put – 2 | GS | January 19, 2018 | $185.00 | $1,367.51 | Active | +99.56% |

| Naked Put – 3 | MRU | September 15, 2017 | $38.00 | $361.30 | Expired | +100.00% |

| Naked Put – 5 | V | January 18, 2019 | $70.00 | $610.00 | Active | +38.52% |

| Naked Put – 3 | V | January 18, 2019 | $90.00 | $1,155.00 | Active | +42.86% |

Table #5: Options contracts sold during 2017.

Capital Gains

If you’ve read my first three quarterly net worth reviews, you’ll know that I had sold quite a few options contracts throughout this year (see table above). All contracts, except for the Chipotle Mexican Grill (CMG) put contract had worked out well and in my favour. If you need a refresher to get up to speed on how I make money with options, check out this options basics post.

For CMG I will most likely have to buy the stock at a higher price as the current price of CMG had dropped significantly lowered than the strike price. This options is certainly a bad decision and trade on my part. There’s definitely room for improvement going forward.

Further more, you may see that my covered call contracts for McDonald’s (MCD) and Caterpillers (CAT) were losing money and may be wondering why is it still in my favour? The reason is that I own both stocks. I just have to sell it at a lowered price than the current market price. I may make less money on these trades, however, I am still making about 50% even selling these two stocks at the agreed strike prices.

The total capital gains for the options premiums are about $20,000 this year. I also have about $47,000 in capital gains from a few stock sales. The major source of the capital gain is from the sale of my McDonald’s stocks. The purchaser of my McDonald’s option exercised the rights to buy the stock from me and I had to sell it. I better find a way to offset these capital gains or else I’ll be looking at a five-figure tax bill next April.

Dividends

Not all dividends collected are equal in terms of income tax treatment. Only dividends earned from Canadian eligible companies get the preferential tax treatment. Dividend is taxed at a lower tax rate comparing to normal income. This is the reason why my non-Registered investment account is made up of mostly Canadian dividend-paying stocks. For non-Canadian dividends, it’s treated as normal income so it’s not tax efficient.

There is no maneuver to lower your dividend income. However, you do get a dividend tax credit for Canadian eligible dividends. The amount of credit you get is determined by the amount of (Canadian eligible) dividends that you earned during the year. For me, the total amount of dividends that I collected in my non-Registered investment account for the year is about $24,000. I can see my tax bill inflating pretty quickly already.

One of the benefits of getting these dividends on a regular basis is the added cash flow. I can comfortably pay for my investment loans on a monthly basis without any added stress to my budget. Simply put, my investments are paying for itself.

Interest Costs

Since I borrow about $700,000 at 2.59% per annum, my interest cost is about $18,130 (=$700,000 * 0.0259) per year. On top of that, I also invest with a margin account for my U.S. stocks and the interest can add up to about $10,000 Canadian per year. Hence, I get to deduct about $28,130 from my income at the highest tax bracket. If I can lower my capital gain to about $0, then I will get a huge tax refund (my highest combined tax rate is 43%). The trick I use is in the next section.

Rebalancing

When you buy a basket of stocks, there’s a very high chance that you will have a loser or two in your picks. Even the best stock pickers still have losers in their portfolio so don’t feel bad if you have a couple of losers in yours. I also have a few losers too. It sucks when that happened, but it’s unavoidable. Just minimize the number of losers and play the percentage game. If your stock picking success rate is 65% or above, you’re in great shape.

It’s really painful for me to write this section, but I need to make myself accountable for my mistakes. I just have to treat this as an expensive $65,000 lesson learned for this year. Due to the terrible oil price and excessive supplies for the last three years, my investment in the oil sector lost about 75% of its value. This cost me more than $65K in losses so I sold my stocks in this sector to offset my capital gains.

Ideally, I’d like to have zero losses and would be happy to pay my fair share of income taxes. Unfortunately, I am not perfect and made quite a few mistakes. Hopefully, I will make fewer mistakes and be able to balance my portfolio better in the future. Due to my $65,000 lesson, I am rating this category with a “need improvement” rating.

2017 Year-end Overall Performance

Overall, this year has been a great year from a net worth growth perspective. Anytime when my net worth grows over a $100K or more than 10% year-over-year, I am satisfied with these results. On the other hand, I am only content with a reasonable annual return of 7% from my investments, but not satisfied. Every year, my investment goal is to beat both the Candian’s S & P TSX Index and the U.S.’s S & P 500 index. Unfortunately, my performance only exceeded the Candian’s S & P TSX Index and lags the U.S.’s S & P 500 index by more than 10%.

Every year, there is only one number that matters to me – my net worth. Regardless of what happened in each of the categories, the bar is set at 10% net worth increase. If my net worth increased above this number, then I’ve exceeded my own expectation. Anything less than 10% is not meeting my expectation. As a result, the 16.8% increase in my net worth deserves an “exceed expectation” rating.

Financial Goals For 2018

I can’t end the year with no goals for next year, that’ll be irresponsible of me and no one will slap me around if I didn’t meet expectation next year. So here are my Freedom 48 goals for 2018.

1) Increase my net worth by 10% in 2018 ==> $1,500,000

2) Maximize the contributions to registered saving accounts for the family

A) TFSA = $11,000

B) RESP = $5,000

C) RRSP = $17,000

D) Total Savings = $75,000

3) Build another $10,000 family vacation fund

So readers, how often do you conduct your net worth calculation? What financial goals do you set for yourself in 2018? How do you balance your current lifestyle with saving for the future?

About Leo

About Leo

Leo, impressive 2017 results with a 16.8% net worth gain.

Good luck with the 2018 target

When do you reckon you will reach $2 million net worth?

@John, happy New Year. Based on my wealth building post, here’s my projection with three scenarios below. If I really have to guess, I would predict the end of 2023.

Leo – great stuff! I’ve just started following your reads 3 days ago and found myself on your site for about 1-2 hours each day.

I’d love to find out if you can share how you were able to borrow at a fantastic rate of 2.59% for $700k!

DW

@DW, welcome to the iSaved5K personal finance community and happy new year. I am happy to hear that some of my posts are useful :).

For my borrowing (good debts), there are two parts. The first one is the rate and the second one is the amount. There is no magic in the low rate as I used my mortgage to take out part of my investment loan. So the 2.59% is the same rate as my mortgage rate. Most people can still get that rate from the big banks up until about five months ago.

The second part (the amount), takes a bit more time, effort and planning. I bought my first house around 11 years ago with a 20% down payment. As the house price goes up, I refinance my mortgage to borrow up to 80% of the market value of my home. For the last ten years, house price had definitely more than doubled in the Greater Toronto Area and I refinanced my mortgage three times. This is where most of my good debts comes from.

Great job Leo and congratulations! A10% or like you said 100k or more increase in networth every year is such an awesome result. You seemed to be doing a lot of things financial, options, equity, and blogging. May I ask if you’re doing all of these on a full-time basis?

I’d like to know more about the 700k rate of 2.59%.

@Bernz, Thank you for the kind words and happy new year to you. When you say doing “these on a full-time basis” I suppose you mean if I am doing this for a living. In short, no. I have a full time job. For my real estate, equity and options investments, and blogging, these are all done in my spare time. I really enjoy managing and growing my own money and blogging. So, this is not work to me. It’s a hobby.

For more info on my 700K good debts, see my response to DW in the comment above.

Thanks for that info on the 700k loan Leo. Wow, you sure do have a lot of energy to do all this considering having a full-time job as well. Looks like yore also invested/traded in equities. Are you in FAANG stocks. Been with this group for two years now and it’s been great. Looking good so far in the first four days of 2018.

@Bernz, congrats for getting in on the FAANG stocks two years ago (for those who are wondering what FAANG is, it’s a group of technology stocks: F=Facebook, A=Apple, A=Amazon, N=Netflix, G=Google). I had always tried to get in, but just couldn’t find an entry point. I am just too cheap to pony up at the current prices. The most that I ever tried to do was sell put options for Apple and Google, but they never go down to my strike price. I am still happy making the free money on the options premium though.

Wow, nice. I’ll have to see what my net worth is. Probably like $40. But I’m always about increasing that!

@Amber, you’re just being modest. I think that you just forgot to put a few zeros behind your number.

omgosh Leo! You’re definitely killin’ it! Fantastic job!

Boy, do I ever wished that I was at that stage RIGHT NOW haha! Keep it up!

I hope to see you one-day teaching financial literature at schools during your “free” time 😀

@Fin$avvy Panda, I know that you will get there in a few years. From what I’ve read on your site, you are way ahead of me when I was at your age.

When I reach financial freedom, teaching finance to high school kids or to anyone at a community centre will be a passion that I want to pursue. I have a few ideas on how to do that and hopefully I can find the space to do it.

I’ve never even thought about our net worth. Wonder what it is?! I’ll have to try and figure it out.

@Joanna, the earlier you start, the earlier you’ll be on your journey to financial independence. You won’t know where you need to go unless you know where you currently are.

Very smart Leo – you are fearless in sharing your information! I really appreciate this because you are unselfishly providing knowledge to everyone who is wants to learn healthy financial strategies.

@Rebecca, it may seem like I am sharing a lot of information, but in a way it’s not a lot. When people see my results, I hope that they’ll be motivated to start their financial independence journey. One year at a time.

WOW go you it looks like you have made some great strides in the last quarter and how amazing to have shared how it is all going with you. Good luck with it only getting bigger and better.

@Sarah, the last quarter of 2017 had been a great quarter. I am hoping that 2018 will be a great year for all of us too.

Wow! You are certainly a more disciplined saver than I am! Thank you for sharing this information with us. I’ll be checking around your posts to see what other information I can glean from you. If I could even manage a small percentage of the success you’ve had saving, I would be happy.

@Angela, thank you for the kind words. The formula to my financial success is not very complicated. You are definitely right about one thing: discipline. I always save first and spend what’s left of my saving instead of save what’s left of my spending.

We bought a home this year and 2 vehicles that are now paid off and I have never sat down to map out our entire net worth

@Erin, a net worth calculation is just a snapshot of your financial picture at one point in time. If you have no financial goal, doing a financial net worth review is just getting a number. However, if you have a net worth number that you want to achieve, doing a net worth review at a regular interval will monitor your progress to ensure that you are on track to achieving your financial goals. For me, I want to achieve a net worth of $2M so I can achieve financial independence and have the ability to choose if I want to continue to work or not.

woah! a lot of numbers and $ !!! Very inspiring, this just motivates me to work hard more than I am doing right now. You are an inspiration!

@MJ, it’s never too late to get started. While you’re at it, set a financial target or two to achieve so that you have something to look forward to. This net worth number can be very motivating, I can guarantee you that.

WOW, you are very organized and such a great saver. Thank you for all of the wonderful tips and info you have shared with all of this, it is true to help us. You have made great financial choices, thanks for all of this Leo.

@Andrea, what I do is not very complicated and anyone can do it. You won’t achieve anything if you don’t have goals. I just set financial goals every year and try to achieve as many of them as I can.

Woot woot! Congrats Leo. . Almost have to take me out for beers. Great breakdown of all your accounts. Curious why tfsa, rrsp etc are in savings column. Wouldnt they be in investing column? Either way they are both under the asset column so dont really matter. You guys are doing fantastic, keep it up. Where you goijg on vacation this yr? Sounds like you deserve it.

Cheers!

@PCI, you know that I live in Markham and not very far from you. If you have any clients around my area, drop me note after work. I have a case of Ricard’s Red ready for you whenever you drop by.

The reason why I put my TFSA, RESP and RRSP accounts into the savings category is simple. They are savings accounts. That’s what the “S” is in those acronyms represent. Once my money go into these accounts, it won’t come out until I either have an end of the world emergency or I am retired.

We are planning to take a Caribbean cruise in the spring. My first ever cruise. I am both excited and nervous at the same time. I have motion sickness. Hopefully, the ship is stable.

Leo I am not a financial wiz, my husband is. I therefore leave all those transactions and end of year evaluations and future projections to him. I can, however, appreciate the need to evaluate investments in terms of expenditure and returns and Year-End Overall Performance . Also I just fleetingly look at our network. Perhaps I need to pay more attention to it to inform future planning and investments.

@Ingrid, my wife does the same thing – she leaves all the financial management to me. I often encourage her to be more involved in our family finance and you should too. In case of something unforeseen happened to the husband, at least someone knows where the money is :). Risk management.

I am a total data junkie and really enjoyed how you laid all this information out. Your site is about to become a deep dive for me! Really inspiring.

@Caitlin, thank you for the kind words. I like data too and hopefully you can find the numbers in my other posts useful.

Wow! I really need to start getting my stuff together. My husband takes care of most of our financials but now that I started making money I need to be more organized with my financial books. Hope all your financial goals for this year come true as well. Good luck!

@Fely, as your net worth grows higher and higher, a 10% year over year increase will be difficult to achieve. As long as the stock market perform reasonably well, my financial goals should follow suit.

You should definitely get started and set your own financial goals. The earlier you set them, the sooner you can achieve them.

Wow…I must say that was very honest of you. I will have to check out what my net worth is now :p

@Prajakta, when you say honest, I assume that you mean my admission to the $65,000 investment mistake that I made. We all make mistakes and are humans after all. There is no point for me to only share the positive results and not the negative results. I believe that people will benefit just as much from my mistakes as from my successes. Also, this is how I hold myself to be accountable for my financial decisions.

this is motivational as one of my goals this year is to earn financial freedom. great information and detailed explanation, thank you.

@Patricia-Ann, good luck on the financial freedom goal. Do share it with us once you’ve achieved them.

Congrats, Leo! I love seeing those positive numbers. Where I’m from, 2017 was definitely the year of real estate. Interesting to see how you faired with it.

@Jenny, real estate had been performing very well for me and helped me increased my net worth quite a bit. About 30% to 40% of my net worth can be attributed to the great real estate market run for the last decade. Going forward, I am content to just leave the value of my real estate the same every year unless I buy or sell more properties.

Wow, from $1.1 to 1.3M in just one year! Very impressive! And it looks like $1.5 won’t be hard to achieve in 2018 if the markets cooperate.

@Ms99to1Percent, to get to $1.5M, I definitely need the stock market to co-operate, especially the Canadian stock market as the majority of my holding are allocated there. Let’s cross our fingers and hope for another year with a 6% to 9% increase this year.

I totally need to do this! Although, it does look like a lot of work, I love the way you broke everything down for a more manageable calculation.

@Kim, the best time to start managing your money is today. Do delay and just get started. As you said, these calculations are not very complicated and everyone can do it.

Congratulations on ending the year strong, and meeting your savings goals! This is certainly motivating me for 2018. I do have a few investments, and an IRA (starting small), but I need to save more of my paycheck earnings.

I love to read posts like this one. I will have to do the numbers and see where we are at. Keep up the great work.

Congrats for being worth 6 figures. I would love to manifest a 6 figure net worth for myself in 2018!

Wow! What an amazing achievement Leo! I should really ask for an advice to you. I really need to change my budget and spending this year. I think you’ll be able to help me.

You are doing amazing!! Thanks for being so transparent about money, it seems like it’s hard to get concrete info on these types of things these days!

Wow, nice. I guess I’ll have to see what my net worth is. Thanks for encouraging me to check it out!!

I am highly impressed with everything you were able to do in the last year. From raising your net worth by ten percent to being able to lower your debts to only 5.67 percent of your net worth. I really need to sit down and see what I can do to raise my net worth. I know I am paying into a retirement fund but it’s government-run and funded. So I need to do things for myself to build that net worth.

@David, it’s a new year. Don’t wait. Start as soon as possible. You can be in control of your finances.

Amazing job Leo! You are totally rocking it! Thank you for thoroughly reviewing what your strategy has been and what has happened for you this quarter. Good for you for catching the potential over contribution for the RRSP- how did you realize that you were about to over contribute?

You made a lot of money selling options- great job!

Also, great job on converting the cost of borrowing into a tax deduction! I am thinking of doing that soon, but need to continue to research it.

@GYM, I realized at the time that we were expecting to get a year end bonus. I somehow forgot that my wife’s bonus from the previous year was deferred to 2017. I caught it because we often discuss what we will do with those money when we receive them.

Using the investment loan interest cost to lower my income taxes had served me quite well. I was able to get a very generous tax refund as every dollar of interest expense, provided a $0.43 tax refund for me. I would encourage you to look into it and just try a small amount and you will definitely see a difference in your tax return.

Lots of information sharing! Wish I had the time to add up my net worth too..

Great results… this is the snowball, year after year is getting bigger and bigger. Even if you keep the same 10% increase each year the net amount increase will be bigger every year.

I don’t understand why the RRSP saving amount is only $17000.

Regarding your losers (energy), having them in the non-registered account definitely was helpful in offsetting the capital gain.

Anyway, in case that you have losers in TFSA, you can do a in kind transfer to RRSP, take the tax return and invest it back in TFSA or RRSP and in this way you will be able to offset some of the loses.

The withdraw from the TFSA will be available for contribution next year. If you do this in December you can re contribute the amount in January. You will get the return in April so, instead of paying 30% or up taxes you get your return, and use it for additional contributions.

Regarding the borrowing for investing in non-registered account, this is called Smith Maneuver and is very legal if is done right (invest only in canadian stocks with eligible dividends) …

@Cris, the $17,000 of RRSP contribution room is due to the pension contribution at my workplace. It reduces your RRSP room if you have a pension.

For loses in the TFSA, you won’t be able to use it to offset your loses if you move it to your RRSP. Whatever you gain in the TFSA will not be taxed, but if you lose money, you won’t be able to write it off either.

You are right. I am using the Smith Maneuver to borrow to invest. The tax advantage is great. I am getting a decent tax refund as the interest cost is used to offset the highest income taxes that I pay.

Hi Leo

Moving the loses from TFSA to RRSP is not a write off situation. Based on everybody’s income situation, it can help to recover some off the lost money.

As example: TFSA investment of $2000 in a stock which goes down 30%. Your balance is $1400. If you don’t have faith in the stock anymore and want to sell and buy something else, will give you a loss of 600.

Transferring the $1400 to RRSP (if you still have room), with a margin tax of 30% or up will give you a return of at least 420 (for a margin tax of 43% return is $602… the full amount you lost).

Reinvesting the return + the $1400 will give you around $1850-$2000 as a balance.

I know that later when you will withdraw the money from RRSP you will pay taxes but, making a calculation and taking in consideration that you will be in a less margin tax, eventually your new investments will have a 10% return, the result will be better then selling in TFSA and taking $600 loss up front.

It is not as effective solution as in non-registered accounts but still the loss will not be so high and you will feel better that the loss is less.

Anyway Leo, you are doing a tremendous job and your posts are good teaching lessons for everybody.

For anybody who wants to do a change I recommend to listen on Youtube on Bob Proctor’s and You Were Born Rich-DVDs (Proctor Gallagher Institute) videos and to read Think and Grow Rich by Napoleon Hill … amazing life changing inspiring materials.

Great job Leo, looks like you had a terrific 2017. Can’t wait to see how your 2018 goes.

@Matthew, me too. I hope that we’ll get a couple more years of growth until we hit the next recession.

Congrats on a great year! I was able to grow my net worth by about $50k this year through savings, and then there’s these crazy cryptos I bought that have a mind of their own, HA!

Looking forward to seeing what you can do in 2018. $1.6 M?