Half of 2017 is in the books. Now is the time sit down and do a midyear assessment to see how well we have performed compared to the goals that we set for ourselves at the beginning of the year. Conducting a quarterly performance review on my own finance is a fun (don’t judge) and leisure activity that I often enjoy. Especially, when you see the value of your assets and net worth increasing. By the way, I think that I am one of my own toughest critics as I’ve set a lofty standard to measure myself against. So without further adieu, let’s reflect on the following areas: savings, real estate, debts, investments and net worth. I will share my successes and failures with you so that I hold myself accountable for my decisions and we can all learn from my shared experience.

Savings

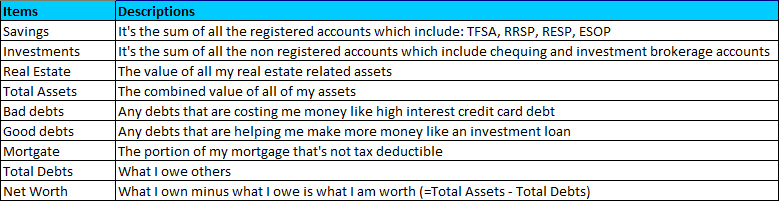

In order to increase your net worth, I believe that you have to develop the discipline to save money first. To develop my saving discipline, I need to ensure that all of my annual financial goals are achieved on a yearly basis. At this point, I am happy to share with you that three out of four of family saving goals (in the table below) for this year had been achieved. I am especially excited about the vacation fund as I had not been able to take my wife and kids on a family vacation since the end of 2012. Hence, this trip is long overdue.

| Items | Target | Amount Saved | Progress |

|---|---|---|---|

| RESP | $5,000.00 | $5,000.00 | 100% |

| RRSP | $17,000.00 | $10,000.00 | 58.8% |

| TFSA | $11,000.00 | $11,000.00 | 100% |

| Vacation Fund | $10,000.00 | $10,000.00 | 100% |

My 2017 family saving goals

Based on the table above, maximizing our Tax Free Savings Account’s (TFSA) contribution room and the Registered Education Saving Plan (RESP) for both of my kids at the beginning of the year is starting to pay dividends, literally. I purchased a few Canadian dividend-paying stocks once we contributed the money and now, we are generating more passive incomes from those purchases. As for our RRSP, it’s still on autopilot mode. For every pay cheque, we are making a 6% contribution to our work’s Employee Share Ownership Plan (ESOP) to get a free 3% matching from our employers. Free money is definitely sweet and I encourage you to take advantage of any free money if there is an opportunity for you to do so.

The second quarter is usually tax filing time. For some people, it can be quite stressful because they either need to find extra money to pay their tax bills or don’t know how the tax system works. For me, I love tax time and filing my own taxes. This is the time that I get rewarded for continuously planning my finances and saving diligently throughout the previous year. After filing my income taxes during this quarter, I was able to get a tax refund of $10,423.59 and use it to fully fund my vacation account. I know that some people will be pointing out that I am giving the government a large tax-free loan. However, getting this refund gives me a psychological boost and it motivates me to do better the next year. So for now, it’s not a huge issue. Since 3 out of 4 goals are now completed, I believe that this category deserves a meet expectation.

Real Estate

If you have been paying attention to the Greater Toronto Area (GTA) real estate market, the sales volume had cool considerably in recent months. However, the price is still quite inflated with only a small decrease based on a month over month comparison. However, based on a year over year comparison, the price of resale homes in the GTA still increased by 6.7% as of June 2017. As I’ve mentioned in my first quarter net worth post, I was not able to find a property that meets my criteria so I decided to fully invest my remaining funds into dividend-paying stocks.

For the past three months, I was spending very little time at my rental property as most of the renovation work had been completed last quarter. The property is now back to operating normally and it requires a minimal amount of my attention. I am back to just managing the rental revenue and my partner back to managing the expenses. I don’t see myself adding more rental properties to my real estate portfolio in the near future. At this point in my life, spending more time with my kids and nurturing them is more important than increasing my real estate assets. Time is such a luxury now.

After operating the current rental property for two years now, we had paid down about $24,000 in mortgage principle. I had not included this as part of my net worth calculation as I wanted to be conservative and leave some room for future error. In addition, I just checked the recent sales data of similar properties in my rental area and noticed that the market value had increased by approximately 20% from my purchase price two years ago. Once again, this increase was not reflected in my net worth calculation as I only include the invested capital for this property only. All in all, this quarter is a quiet quarter on the real estate front and I am content with the lack of activities. Hence, this category is rated with a boring borderline meet expectation.

Debt

There hasn’t been a lot of activities on this front and I am content to take it slowly in the debt category. I had been paying all my credit card bills in full every month, paying my mortgages on time and did not incur any additional consumer debts. Talking about credit cards, I’ve just got my new Rogers Platinum Mastercard recently and I am excited to use it to earn a 1.75% reward for all my purchases. On average, this card will provide me with the most rewards for my spending. I got the Rogers Platinum Mastercard because I was disappointed with the Tangerine Mastercard as they cut back their cash rewards from 1% to 0.5% for regular purchase categories that are not on your 2% rewards list.

Sometimes, being boring with your debt is not a bad thing. With that being said, I am always on the lookout for opportunities to increase my net worth. If I need to further increase my good debt to make that I happen, I am more than happy to proceed as long as I am getting paid to borrow more money. So I’ll give this boring category a borderline meet expectation.

Investments

The investment category had always been my favourite category to discuss and share. At the beginning of the year, I had about $45,000 of cash that I have yet to deploy. By the end of this quarter, I am happy to reveal that I have put most of that money to work and purchased a few Canadian dividend-paying stocks. I am now seeing a noticeable increase in the amount of dividend income from my non-registered portfolio. For the first six months, my non-registered Canadian stock portfolio received about $8,500 in dividend payments. I am hoping to hit $18,000 by the end of this year.

Most advisors would recommend against timing the market. However, I prefer to time the market especially when it comes to writing options. This quarter is a relatively active quarter as I was able to time a few of my options trades, which will be explained in a bit (see my post about options basics if you need to get up to speed). Most of the time, I tend to write my options contracts close to the end or the beginning of the calendar year. I prefer to write my options contracts with an expiry date of about one year or so to maximize the premium that I collect. One of the factors that affect the premium of an options contract is time. The longer the expiry date, the more premium the purchaser needs to pay. Also, as time passes, the value of the premium decays, which works in my favour because time is helping me make money.

The way how I make money with options is similar to the flow of sand in an hourglass. At the beginning, when I just sold the options, the money that I make is close to zero, which represents very little sand in the bottom half of the hourglass. As time goes by, more and more sand will flow to the bottom half, which means I will be making more money as the value of the option (the top half of the hourglass) is worth less as time goes by. I get the free money when the option expires. Similarly, all the sands flow from the top half of the hourglass to the bottom half.

There are two strategies that I use when I write my options. For covered call options, my preferred time to sell is when there is momentum in the stocks that I own. By that, I mean the price is at 52 weeks high or an all-time high and there’s a lot of euphoria and optimism about the stock. I would set the strike price to be even higher than the current high price. My intent is to earn the free premium most of the time and not to sell the stock when I write the covered call options. This transaction takes advantage of the greed that had been created in this stock. Selling the covered call options for Extra Space Storage (EXR) highlights this strategy during the past quarter (see the options table below).

For naked put options, my preferred time to sell is when there is fear in the stock. By that, I mean there is either bad news related to the company or the company had just reported their quarterly financial result that did not meet analysts’ expectations. I would set the strike price to be even lower than the current low price.

My intent is to buy these great companies at an even lower price, but I am content to just earn the free premium if the stock price doesn’t go lower than the strike price. Selling naked put options for the Bank of Montreal (BMO) and Goldman Sachs (GS) highlighted this strategy during the past quarter (see the options table below). Both of these institutions had earned decent profits in their latest quarter, but they did not meet the analysts’ lofty expectations. Both of these stock had a significant drop in price after they reported and that was my time to sell the naked put options.

| Options – Contracts | Ticker | Expiry Date | Strike Price | Premium | Status | Return |

|---|---|---|---|---|---|---|

| Covered Call – 2 | CAT | January 19, 2018 | $110.00 | $628.00 | Active | -50.96% |

| Covered Call – 1 | CMG | January 19,2018 | $600.00 | $1629.00 | Active | +78.47% |

| Covered Call – 4 | EXR | September 15, 2017 | $85.00 | $685.03 | Active | +67.84% |

| Covered Call – 4 | MCD | January 19, 2018 | $140.00 | $765.03 | Active | -696.34% |

| Covered Call – 5 | WFC | January 19, 2018 | $65.00 | $963.77 | Active | +74.09% |

| Naked Put – 3 | BMO | January 19, 2018 | $88.00 | $961.30 | Active | +14.06% |

| Naked Put – 5 | ENB | January 19, 2018 | $50.00 | $933.80 | Active | -4.28% |

| Naked Put – 2 | GS | January 19, 2018 | $185.00 | $1,367.51 | Active | +54.24% |

| Naked Put – 3 | MRU | September 15, 2017 | $38.00 | $361.30 | Active | +41.88% |

Options sold during 2017.

In the table above, you may notice that I lost more money than I had collected for McDonald’s covered call options. From time to time, this will happen because I probably would never be able to predict a stable company like McDonald’s to increase more than 25% within less than half a year. At this rate, I will most likely have to sell my McDonald’s stocks at $140 per share sometime before it expires. Even with that price, I am still making around 15% on the stock for the current year. Not too shabby. For the rest of the options, they will most likely expire worthless and I will be able to keep all those premium for free. Now can you see why I like timing the market to sell options?

Even with such a great performance on my options activities and a few great performing stocks, I could not escape the horrible performance of the oil stocks and the main Canadian stock market index. My non-registered account’s performance took a huge hit as I moved all my non-performing stocks from other accounts to my non-registered account. I was lucky to escape this quarter with a small increase. As a result, this category gets a borderline meet expectation.

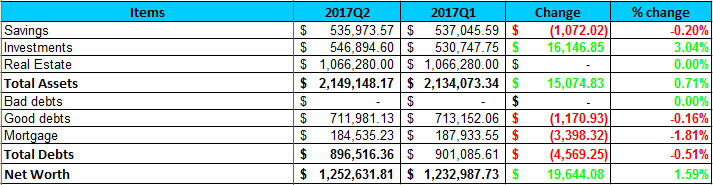

2017 Second Quarter Net Worth Performance

Net Worth

From a quarter to quarter point of view, I don’t pay much attention to the movement of my net worth. I prefer to assess my net worth performance on an annual basis as I think that is a better measurement. Based on the table above, my net worth is performing well compared to the return of the Canadian stock market index, but I lag the S&P 500 index. My 2017 net worth goal is to reach $1.3M by the end of the year. At this pace, it seems achievable and hopefully, my performance can continue to improve. Hence, I’ll give this category a meet expectation as long as my net worth continues to increase on a quarterly basis.

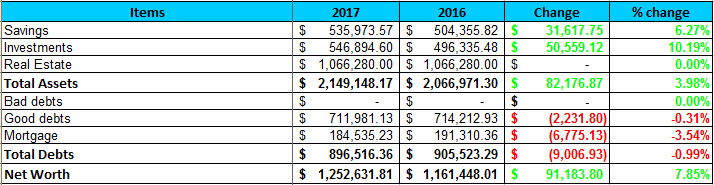

2017 Year-To-Date Net Worth Performance

2017 Q2 Overall Performance

Overall, this quarter had been a mediocre quarter with lots of volatility in the Canadian stock market. There had been quite a few maintenance activities where I moved some of my loser stocks from my registered accounts to my non-registered accounts. For the short-term, I am sacrificing the performance of my non-registered account. In the long-term, more of my money will be tax-sheltered as I bought more dividend paying stocks with the proceeds of the sales. At this point, my goal is to increase my net worth by 10% annually, the return for the first six months is 7.85% still on on-track. Hence, a borderline meet expectation for the overall mediocre performance.

So, how often to you conduct your net worth calculation? What financial goals do you set for yourself? How do you balance your current lifestyle with saving for the future?

About Leo

About Leo

Congrats on the success so far! Really great to be so far along on your savings goals only halfway through the year.

I always enjoy reading people’s strategies and experiences with options. I haven’t jumped into that market yet, but I am very interested and appreciate you sharing your findings.

@Matt, It takes time to fully understand how option works. Once you have learned how to use it properly, it can be a great way to add an additional passive source of income to your portfolio.

As always Leo I admire your investing strategy using ‘smart’ leverage in those combinations of – investment loans, margin, short selling or naked puts

Good to see those option contracts adding to your passive income.

@John, thanks for the kind words. I use most of the strategy that you mentioned, but I don’t short sell. This method can potentially have unlimited losses so I try to avoid it. I am starting to really like selling options. It’s a great way to make free money.

@Leo, FWIW, my investment strategy on stocks that have dividends as well as options was that on the purchase of the underlying stock (within one minute after confirmed purchase) was to option it immediately at the ‘bid price’. It could be in the money or out of the money (generally long) depending on the open interest as well as the implied volatility. Adding that hedge, cushion or extra few points is always good to have.

Whatever works for you I’m sure you have control over the options that you’re doing.

Again, good luck

I love that you enjoy this. I personally would not but that is also because I just have less money to look at. But either way, it is probably good to look at your budget and savings every once in a while.

Congrats on your success this year so far! I need to focus more on the saving discipline! I am going to look into that high reward credit card you mentioned! Thanks for the tips

The day I am going to start focusing on my net worth is going to be painful coz I know nothing. And I come from a finance background, so even worse! Nothing debt wise, I don’t even have a credit card nor a student loan to repay! Congrats on your success this year! xx corinne

It’s so impressive that you can do this! I have never actually sat down and gone through my finances to this level of details. Inspiring!

Wow- I admire your perseverance and good financial habits. You are a great example to follow!!

You are really good at money management and how to invest wisely.

Hi Leo, it is inspiring to see your progress and how you are tracking it so diligently! Keep up the good work!

Well done on being so disciplined and organised with your savings goals. Good luck for the future!

I must admit that I did not follow everything you talked about. I am so not a financial person. Luckily I have people who take care of that for me.

I’m impressed with how disciplined and organized you are with your savings goals. I learned a lot from this.

You seem to be doing great. It’s definitely a smart idea to be checking your financial stability.

I must confess I’m totally innocent when comes about financial knowledge. Your post made me aware of the importance of saving strategies, but I’m still a long way from being an expert. Maybe I’ll need a financial counselor.

Great job on your goals so far this year! It reminded me to check on my own. Post will be published in two weeks. Spoiler alert: I’m on track too. 😉 Don’t you love being financially fit? :))

It does look like you are doing such an amazing job with fulfilling all of your goals for savings. I know I would like to be able to do more of that most definitely.

Awesome job so far this year!!! I have to admit that I still have a stack of cash as I didn’t want to put it into the market while we were house shopping. We haven’t found anything and with the market up 8% so far this year, I feel like a little bit of a dope but such is life .

In terms of calculating our net worth, I know what it is every time I log on my personal capital website. I’m getting closer and closer to one of my life goals, so it’ll be fun to see my reaction when I arrive there 🙂

I hope that someday going over my finances is fun, but right now it’s only devastating. Our government just screwed up..leaving us scrambling and behind on the rent. Our life is really hard and honsetly, this post went over my head as I’ve just never had enough money to invest, and have only been able to save in the short term, never the long term. I do however wish you further success and wealth and happiness.

It’s nice to have no bad debts to log. I used to invest and will do so again at some point, knock on wood.

Wow, I am impressed by your ability to save! This is something I definitely need more discipline in. I am free of debt though so I guess that is something!

You are crushing it Leo, keep it up. $100k increase in 2017 will be a great achievement!

@ Leo, looking at your charts of assets, liabilities, income & debt – is there a reason why the ‘good debt’ of $712k is considerably larger than the ‘investments’ of $547k?

@John, Great questions. I not only invest in stocks, I also invest in real estate. So the rest of the good debt is used for my current rental property and another down payment for a pre-construction condo. I purposely borrow the down payments for these properties so I can use the interest to lower my income tax.

“I purposely borrow the down payments for these properties so I can use the interest to lower my income tax.”

Interesting statement and I’d like to hear additional thoughts – because I hear similar a lot from others who haven’t really thought it through. You are much more conscious of your financial decisions though than most. Basically, you prefer to borrow at perhaps a 4% rate to deduct it and save a percentage of that percentage? So paying $4 on every $100 to save between $1-$2 on your taxes? I suspect there are some situations where this might help (like a nudge to a lower bracket? Or using the leverage to invest the difference perhaps?) so I’d love to hear the thinking for your specific situation.

@Brad, this is a great question. When I say that I borrow to invest and use the interest cost that I paid to lower my income tax, I meant that I want to keep more money in my pocket. Here is an example. Let’s say that I have $20,000 lying around and I want to invest it to make more money. Here are the steps that I use to keep more money in my pocket:

1) use the $20,000 to pay off a portion of my mortgage

2) take out an investment loan of $20,000 (I can borrow at a rate of less than 2.75% annually)

3) Let’s say that I invest the $20,000 in buying dividend paying stocks and get a yield of 4%. I would have to pay tax on the dividend income.

Here is the difference. If I just invested the $20,000 without paying off my mortgage, I would not have anything to reduce my dividend income and I would have to pay tax on the dividend income. But taking the three steps above, I can get some money back in the form of a tax refund because the interest cost is tax deductible. Both methods would give me a $20,000 in investments. However, one method lets me keep more money in my pocket. I hope this explanation helps.

@ Leo,without getting into the nitty gritty what may seem like nit picking, why is ‘net worth’ so important to you or is it?

On RE investing,are you a single property occupancy investor (one property at a time) or a muti-dwelling property investor? What are your thoughts on ‘property hackers’, those that rent out part of the property that they live in to pay the expenses associated with that property?

I/we learned in our early 20’s that cash flow is more beneficial than ‘net worth’ Of course some folks will say with a higher net worth that they can borrow more to invest.

Even today our net worth is just on $1.23 million & that includes our principle home valued at $700k. No RRSP or RRIF’s, no debt, not a single penny owed month over month, we pay cash for most everything. Our 2016 joint income was just over $65k,our expenses as a retired over 65 couple was approx 31% of income, making that a savings rate of 69%. We are on track for similar savings rate in 2017.

John R. Congrats on such an amazing cash flow / expenses! I think it totally makes sense in your phase of life why cash flow is so important. I find in my phase of life that net worth is more important since it is my source of future cash flow. I hit my retirement number in my 30s, but still am not ready to hang it up, in small part (not solely) because I want more cushion.

So looking at your net worth excluding your home of $623k, how are you able to generate 10%+ cash flow? Also, how are you able to lean out your life to keep your spending $20k ish? A large part of it is because you have no mortgage, but how about the rest? You are amazing for accomplishing that cash flow and expense amount!

its really not that difficult. It’s just a matter of that ‘quest for a simple life’. One doesn’t need huge net assets, it really is all about cash flow. Try to get to mortgage freedom & enough income to pay the expenses. Cash is key, well at least that is what we have found, while others believe ‘leverage is the only way to reach a huge net worth’

How much income do you need to reach FI or retire for good without doing a ‘hustle’?

Which streams of income do you have that can weather a QE (another 2008), a meltdown, even a depression or that you may lose that $50k – $100k++/yr job. Then what if ill-health befalls upon you or yours… can you survive and if you can, for how many years?

Do you have enough emergency cash reserves to carry you through any long periods?

Have you ever been rock bottom poor & if so, are you ready to start from zero once again?

It’s nice to know that you enjoy these kinds of things and it shows with how you write about them- with passion. While I am not a “finance” enthusiast nor have investments/assets like you do, I find it interesting but I don’t understand some of it.

Hi Leo,

Just found your site. Amazing job growing your net worth over that amount of time. I remember hitting my first million — my first thought was, “when is the 2nd coming?” You’ll find that the first million is definitely the hardest and that the second comes so much faster, barring a prolonged downturn. We are overdue for one. So for many of us who accumulated wealth from the effects of QE mad ZIRP, it will be interesting to see how they react in a downturn. I myself lost hundreds of thousands and over half of my then net worth. Bad memories. But I learned from it.

Are your numbers demoninated in Canadian dollars? Have you done a comparison between your active investment style vs. an S&P 500 ETF? I’d love to see that analysis. I’ve made my wealth as a passive investor.

Also, good call on holding off on a real estate purchase. When the nyc market took a hit, the first sign was volume. Momentum is important.

@JT, I definitely agree that the first million is the hardest. For the second million, it’s getting easier as I am a quarter of the way there and it’s not even one year yet. My net worth is denominated in Canadian dollars as I am a Canadian.

As for the downturn, I have no idea when it’s coming and quite frankly, I don’t really care if it’s here. If things go south, I will back up the truck and start loading up on cheap stocks. I have quite a bit of flexibility.

For any investment, if it doesn’t make sense to me, I’ll definitely pass up on it as I believe if I have the capital, I can always find an opportunity that will make sense for me. It’s better to miss an opportunity than to invest in something that does not fit into your philosophy or strategy.

@JT, on the S&P 500, well this could be for the sophisticated investors that know how to play the market volatility, just like investing in a VIX index ETF. It’s easy money if folks know what they’re doing, doesn’t require a lot of knowledge or expertise, just common sense & no emotion.