Recently, I was working with someone close to me to analyze an investment opportunity. Let’s call this person Joe so that I don’t reveal his identity just in case he reads this post and doesn’t like what I have shared. Not everyone is open to sharing financial information or personal stories like me and I totally respect other people’s privacy. The reason that I wanted to share this post is that it’s a topic that I am deeply passionate about. I want every reader to take a step back and ask him/herself, would you borrow money to invest if you have the opportunity?

Background Story

A couple of months ago, Joe’s father had just sold his house and he wanted to help Joe buy a property to build some assets and get into the sizzling hot Greater Toronto Area (GTA) real estate market. I was enlisted by Joe’s father as the trusted Realtor and financial coach to guide Joe through the home buying process as Joe is a first time home buyer. Within a short couple of weeks, I was able to find a property that suits both of Joe’s and his father’s requirements. Now, the question is, “What should they do with the financing of the new property?”

The Investment Opportunity

Joe’s father is a very caring and generous individual as he is willing to pay for the whole purchase of Joe’s new house. When this fortunate financial situation arises, there is an investment opportunity for Joe to diversify his assets into the stock market. With a great deal of financial flexibility, I recommended Joe to first pay off the purchase of the house and then borrow money with a mortgage loan to invest in the stock market to build wealth for the future.

Procedure Matters

When Joe has a mortgage-free home and borrows money to invest via a mortgage loan, the interest that he pays on the loan is tax deductible. He can use the interest cost to lower his income tax as he uses the proceed of the loan to earn income. This is totally legal under the Canadian tax law. On the other hand, if Joe were to put a 70% down payment on the house, got a mortgage for the rest of the 30% and used the remaining money to invest, the interest on the mortgage won’t be tax deductible.

The Difference

What’s the difference between the two methods? In terms of net cash inflow and outflow for Joe, there is no difference. The difference is in how the Canada Revenue Agency (CRA) categorize the investment money. It’s the 30% of the money that Joe did not use to pay off his house and used it to invest instead. Since that 30% was not borrowed money, there is no interest cost to lower his income. In addition, if the 30% of the money was a loan from Joe’s father, then Joe can use the interest that he paid to his father to lower his income tax. However, Joe’s father now has to count the interest payment from Joe as income and will have to pay tax on the interest income. Hence, a simple structuring of the flow of money can greatly affect how much income tax Joe pays.

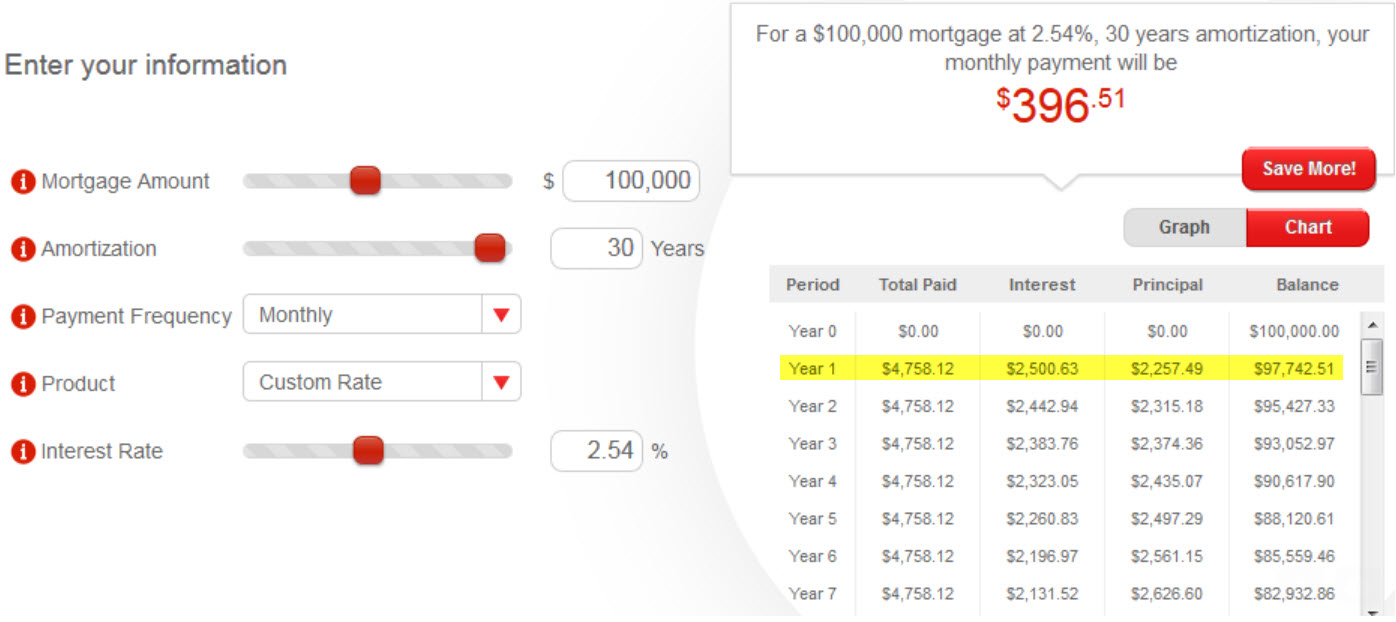

The Mortgage Terms

Since the cash proceed from the mortgage is used for investment, the goal is to prolong the amortization period of the loan as much as possible to keep the monthly payments low. Also, locking in the mortgage at a fixed rate for five years will provide cash outflow certainty and keep the payments consistent for that period. I was able to obtain a quote at one of the five big banks at an annual rate of 2.54%, fixed for a five-year term and amortized over a 30 year period. The total monthly mortgage payment for both interest and principle comes to $396.51 to borrow $100,000.

The Investment Portfolio

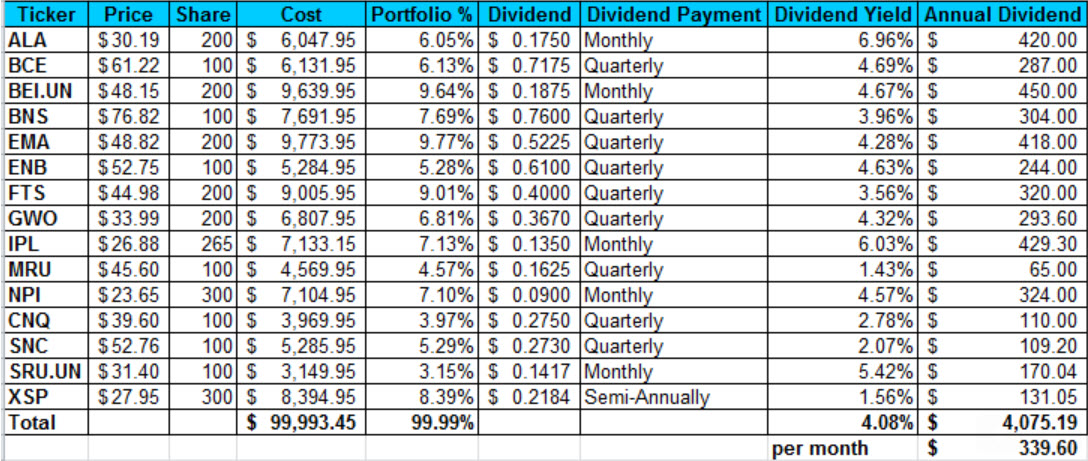

Last year, I had written a post about how I got paid when I borrowed money from the bank with a portfolio constructed from a list of Canadian dividend paying stocks. For Joe’s portfolio, I constructed a similar list of Canadian dividend paying stocks with a bit of exposure to the U.S. market through an ETF that mirrors the S&P 500 index (XSP). This portfolio’s dividend yield is about 4.08% based on the purchase price on June 01, 2017. On average, this portfolio will receive about $339.60 in dividend payments per month.

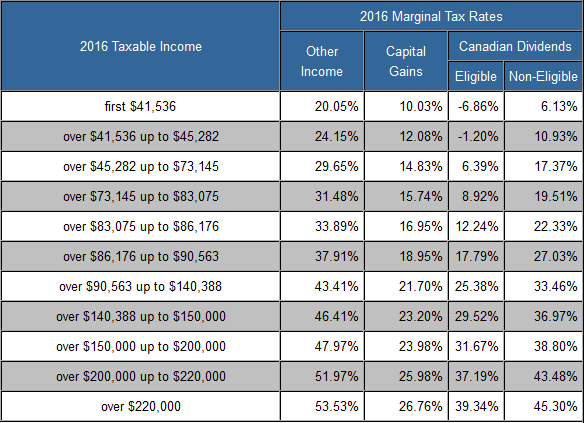

Sourced from TaxTips: Ontario Marginal Tax Rates

Income Tax Considerations

If you’ve been reading my blog, you would know that income tax is always at the forefront of any discussion when I am evaluating an investment. Since Joe lives in the province of Ontario, let’s assume that he’s making a modest annual salary of over $45,916 up to $74,313 (the third lowest marginal tax bracket). Since he paid a total of $2,500.36 in interest for the first year, he’ll receive a tax refund of $741.44 = ($2500.63 * 0.2965) based on his current marginal tax rate. Joe also has to pay tax on the dividend income too. He’ll have to pay $274.79 = ($3944.14 * 0.0639 + $131.05 * 0.1737) based on his current marginal tax rate (I have split the tax calculation as the dividend received from U.S. Stocks do not receive the same tax incentive as Canadian dividends). Assuming that the dividend income and the interest cost do not move Joe’s taxable income into a higher or lower tax bracket.

The Cash Flow

For now, for simplicity sake, let’s just assume that the average monthly dividend payments from the stocks are available at the end of the month and ready to be used for the mortgage payments. With simple math, the cash outflow is $56.91 = ($339.60 – $396.51) per month. Hence, to borrow $100,000 for investment, Joe will have to have a forced saving of $682.93 = (12 * $56.91) per year. However, when we factor in the cash flow for the tax refund and the dividend income tax payable, Joe only need to pay $216.29 = (-$682.93 + $741.44 – $274.79) out of his pocket annually.

The Overall Financial Benefit

The overall financial benefit for Joe is equal to the mortgage principle paid plus the tax refund for the mortgage interest minus the forced saving amount and minus the income tax paid for dividends earned. On an annual basis, Joe makes approximately $2,041.20 = ($2257.49 + $741.44 – $682.93 – $274.79) just by borrow $100,000 to invest. For the duration of the first five years of the mortgage term, Joe makes approximately $10,206.00 = (5* $2,041.20). This does not include any potential dividend increases from the stocks and the potential capital appreciation of the stocks.

The Breakeven Analysis

Based on the overall financial analysis calculation, if the total value of Joe’s investment after five years is worth $88,000, then Joe will breakeven for this endeavour. He will have approximately $100,000 = ($88,000 + $10,206.00 + $12,000.00 * 0.1483) if he sold his investment at the end of five years and claim a tax refund of approximately $1,800 = ($12,000.00 * 0.1483). Hence, he’ll have a 12% safety cushion for this investment maneuver. He’ll only lose money if the value of his investment is less than $88,000 and he will make money if his investment value is more than $88,000 after five years.

The Ultimate Questions

Before Joe makes the decision to borrow money to invest, I asked him a couple of questions to get him thinking. Why are the majority of people waking up every morning to go to work? Isn’t it to earn money? What would you rather do, you work for money or have your money work for you?

Having A Financial Coach

Since Joe is pretty much a novice when it comes to investment, I wouldn’t recommend that he jumped into the financial market alone. That’s like throwing a sheep out in the woods with a vicious pack of wolves lurking around. With my financial background and investment experience, I offered to be his financial coach to guide and help him set up everything. In the short term, I’d hand hold him through all the steps, but in the long term, I’d prefer Joe to take over and be responsible for his own money.

My Two Cents

For now, I will not reveal what was Joe’s decision as I want my readers to put themselves in Joe’s shoes. If you were in Joe’s situation and have a similar opportunity, would you borrow money to invest? Or you would choose to live mortgage-free and continue to work for money?

About Leo

About Leo

No, I would not borrow money to invest. No way, no how. My reasoning is documented here: https://maximizeyourmoney.com/financial-fitness/should-you-pay-off-your-mortgage-early/

I early-retired at the age of 44. I had the question at that point of paying off a million dollar house we had, or putting that money into investments. Well, I chose a third option – sell the big house, pay cash for a smaller one, then put the difference in investments.

Now with ZERO debts to my name I sleep much better at night. 🙂

@Brad, your option is very interesting and responsible. If not investing will allow you to sleep better at night, then that’s the option you should take. Everyone’s risk tolerance is different and I am glad that you know the option that’s best for you.

Great reply and I appreciate the links to those posts. I don’t think I’d borrow to invest, but mortgages on rental properties is effectively borrowing to invest….so maybe I would…

Great post nonetheless!

Thanks for this post Leo. Last year I actually did borrow to invest. I paid the loan off in 14 months I don’t regret doing it but I don’t think I will do it again.

@Matthew, It was great that you were able to at least try it know that borrowing to invest is not for you. Only take actions that you are comfortable with being at peace with your decision.

Like Joe I am a novice in such matters and I only ventured once into a high rate giving back bank deposit ( I don’t know the correct term). If I were to borrow money I would definitely use a financial coach!

@Akamatra, the key to investing is knowing WHAT you are investing in. If the knowledge is not there, enlisting a financial coach is definitely a great idea. Just make sure that it’s someone that you can trust and have your best interest.

To be honest I wouldn’t feel comfortable borrowing to invest. I get too paranoid about things like that.

@Jessica, If borrow to invest adds another level of stress or complication to your life then it’s best to do what you’re comfortable with and only take on more risk if you are able to tolerate it.

I feel that it’s risky if you don’t know how to do it the right way. With the proper mentor, it would probably be a profitable choice! 🙂

@Milton, having a mentor to assist you is definitely a great idea. Sometimes the mentor can work with you to improve your portfolio if you are not taking enough risk or too much risk.

Great article. I think that it really depends on the current economy, and a person’s individual background and budget on whether or not they should borrow money to invest.

@Shannon, you’ve hit a few key points that really needs to be considered when you borrow money to invest. Being able to have the extra cash to cover your loan payment in your budget is important. It’ll lower your risk if your investment stops paying you dividends.

I’m not sure that I would be comfortable borrowing money to invest. I definitely would not borrow it from an individual for this purpose, but I might think about it in terms of how you explained using a home mortgage. Then again, having a house free and clear of a mortgage would be a tempting thing.

@Jessica, I can understand the freedom of a mortgage-free home brings. Sometimes when you’ve worked so hard to be debt-free, you may not want to go back into debt.

There are so much things that you have to consider. I like both thinking but always prefer to invest what I really have instead of having a debt on my shoulders. But also it depends of the type of investors you are or where you are at in your life

@Emmnuelle, It’s a great point that you’ve made regarding the point in your life that you are at right now. For the individuals with high income, has an established career and are looking for ways to further increase their net worth, this is a great area to find opportunities.

Good topic Leo & I get the message & from what you posted on your blog see that you have been doing this….successfully I trust?

On the question: That we have borrowed in the past to make & to get our net assets where they are today that in part provide us with additional income at the lowest of low tax base.

When we were young & foolish we borrowed for several investments, mainly real estate. Wasn’t till we were in our 50’s that we borrowed, leveraged & hedged to invest in the stock market..

Leo from reading your blog I see that you leverage, borrow & take calculated risks & that you are always able to cover your positions. Wonder how many DGI even understood that last point?

Back to the question on borrowing or leverage to invest… from me the answer is yes. Could I do it today at age 70 & sleep at night…absolutely. Like all the multi-billionaires nothing fazes me when it comes to investing, for two reasons – 1) we started doing this in our 20’s & have been through the mill, 2) in my career I was doing this in part when working for an International as well as a multi-national corps.

Borrow what you can afford to pay & when the ROR is at least double what the carrying cost are. Don’t get caught in a margin call or having to pay the loan on notice.

For the novice I would suggest ‘educate yourself, research, paper trade’ to and/or having a ‘tutor’ to help you through the maze.

Leo is a knowledgeable guy IMO

@John, I have been borrowing to invest for about nine years now. Some of the wealth that I accumulated were attributed to borrowing to invest and receiving the tax benefits from the money that I borrowed.

008

Being able to take calculated risks and managed the effect of the downside of your investment is important. I was in a bit of trouble in early 2009 and learned quite a bit from my margin calls. Those experience lead me to fortify my investment afterward and I made sure that any investment that I took, my chances of succeeding is a lot greater than my chances of failure.

Education and experience are quite important in my opinion. By surviving the crash in 2008, I was armed with experience and know-how that you can’t learn during bull markets.

Thanks for the kinds word by the way 🙂

It’s such a difficult decision, you could make your money back and be able to pay off your loan, but if your investment fails you are in much deeper debt.

@Fashion-Mommy, the risk is definitely there. Since the money is spread out into 15 different stocks/ETF and the dividend yield is at 4%, the downside risk is being managed and reduced. Back in 2008, one of the worst financial meltdown in history, most of these companies were still able to continue to pay their dividends. That says a lot about these companies when they were able to demonstrate that they can thrive in one of the worst operating environments for their business.

This is important to keep in mind. I don’t think I would borrow money to invest–you just never know if things will go wrong.

@Amber, the opportunity will always be there as long as you own your home and has a decent amount of equity in your home. You never know when the next recession is. It may be a great opportunity to buy stocks on sales.

I’m too conservative so I wouldn’t borrow money to invest. To me I hate debt and would rather get rid of debt b/c I am terrified that the market would turn on me for being greedy. So in turn I would get punished. So I personally wouldn’t do it but I get why other people would 🙂

@MSM, I understand that some people are very risk-adverse and it’s perfectly fine. I sometimes do wonder what’s like to be mortgage free and not having to make mortgage payments on a monthly basis. I may consider this route if my net worth is close to my FI goal of $2M.

I don’t know if this is something that I would do. I would have to talk to many people before making a choice.

@Sondra, the more people that you can talk to the better. Try to talk to people who had experience with borrowing money to invest. The more questions you asked, the more informed you’ll be. Just remember, the choice is yours and you don’t have to do it just because other people are doing it.

No, I would not borrow to invest. I would rather work with what I know I have in the bank.

@Tanya, there is nothing wrong with this option. It’s best to not take the risk if you are not ready to take on.

I don’t know much about investing. But I don’t know that I would borrow money to invest, seems risky.

@Nicole, before you borrow to invest, it’s best to get yourself up to speed on personal finance. Without knowledge, any investment can be risky.

I don’t think I would borrow to invest. I would rather have a stocksand shares ISA and do it that way. Its all my money, I get the rewards and never need to lose a penny and also never need to worry about debt.

@Anosa, sometimes, being debt free is more important than the opportunity to make more money with debt. I totally understand and would not advise people to take on additional risk if they are not comfortable.

I would say that it depends on how you handle your money but it’s sometimes wise to borrow money and invest it. It really depends on where you’re investing the money.

@Amanda, this is definitely true. I only borrow money to invest in Real Estate and the stock market. These are two areas that I know well and comfortable investing my money in. For other investment, I will most likely not venture into as I don’t have the knowledge or know how.

I don’t think I would borrow to invest. I would try and do it on my own. If it was something I knew would work out and would be successful I would give it a try. Nothing is for sure.

@Cynthia, knowing what you would and wouldn’t do will definitely help you decide if borrowing is the right option for you. When in doubt, don’t do it. It’s better to be safe than sorry.

Man, good topic. Someone once argued about “that even the rich people have their own debts.” I mean I’m against it. Are you really rich if you are in debt?

@JD, you can definitely be rich and still be in debt. In fact, some of the billionaires owe billions of dollars in debt and they are still rich. Why? Because You Net Worth = Your Assets – Your Debts. If you assets are great than your debt and they are in the millions or billions, then you’re rich.

I can understand why people would borrow money to invest, but I don’t think I would at this point in my life. I’m guessing you have to do this very strategically if you decided to.

@Kaitlynn, knowing when to invest and when not to can greatly help you in the long run. For example, if you are carrying thousands of dollars in credit card debt, it will not be wise to invest before you repay all of those high-interest debts.

This was such a great article. You made some great points and made me think about stuff like this which I hadn’t before. Great list and thanks for sharing.

@Jackie, thanks for the compliment. Getting people to start thinking about their finances is one of my hobbies as I love to start a conversation with other to discuss anything that’s related to finances. Hopefully, my questions will encourage you to further investigate more investment opportunities.

I was just having the discussion this weekend. I totally 100% understand why some people choose to take on the debt I personally never would. I just don’t like the risk associate with it. If I want to make a lifestyle change or I get laid off the bank still wants that house payment every month.

Now I say that but I am currently investing and not paying extra on my mortgage. But I’m not going to refinance to invest.

@Grant, Everyone has his or her personal preference and comfort level when it comes to managing their finances. You can achieve financial independence in many ways like managing your debt and lifestyle.

I’ve got to admit that most of the post went over my head. Investing is something that is one my list of things to read about and learn because I would really like to invest but I just don’t fully understand the process yet. I don’t think I’d borrow money to invest though. It seems like too big of a risk for me. I’d prefer to invest my own money.

Michelle | She’s Not So Basic

@Michelle, there a lots of resource on the internet and lots of personal finance bloggers to help you. It may seem confusing at first, but slowly, things will become more and more clear after a while.

Wow, I never thought of borrowing to invest. This was a very insightful post, thank you.

@Steve, it’s not too late to think about investing, regardless of your age. The earlier you start learning about investing, the better the position you’ll be in to increase your net worth.

At this point in my life, I wouldn’t feel comfortable borrowing to invest. Perhaps in the future, but not currently. I love the extensive breakdown you do, though! Extremely helpful.

@Caitlin, I am glad that you find it helpful. Hopefully, when you are comfortable enough to take the plunge in the future, you can still refer back to this post.

For me, borrowing money depends on what I’m investing in. You can’t borrow money for every investment.

@Oyinkan, you are right. There is some investment that I would not borrow to invest like collectibles or classic cars. I like to invest in vehicles that pay me on a regular basis.

First, it is great that you have a Canadian tax law implemented. It is a bit different here in the Philippines. I personally would want to have a cushion first, aka an emergency fund of at least a month’s worth of expenditures before investing and saving at the same time. 🙂 Borrowing money to invest is not in my mind as of this moment.

Leo, maybe you have come across this question for those that are mortgage free or who have at least 50% equity in their home residence that want to borrow from themselves & pay themselves at the same time?. On that basis, suppose an existing TFSA has $52,000+ and the RRSP as in access of $100,000. From what I have read it’s possible to hold a mortgage on your own principle property within the RRSP or the TFSA.

http://www.moneysense.ca/columns/loan-yourself-a-mortgage/

Taking that is a given, then mortgaging your own property to yourself using the funds in your own registered account, you are then paying yourself. interest lets say the going rate of 2.50%. The equity taken out (swapped for cash from one of the registered accounts) could be used for investing in DGI at 4%+.

This is really no different than getting a HELOC or re-mortgaging only that you are paying yourself the interest to the registered account.

@John, If I understood your question correctly, you are trying to…

1) Get a mortgage for your property with at least $100K in equity

2) The lender is either your RRSP or TFSA account

3) You use the proceed to fund a non-registered investment account and pay a 2.5% interest rate to your lender

4) The cash flow is almost neutral using similar numbers to this post.

If my interpretation is correct, then I see don’t see the added benefit to this maneuver because of the following:

1) You’ll be limiting your registered account to just earning 2.5% annually

2) Let’s say that you are a great investor and double your investment in five years and then cash out. You’d have to pay capital gain tax on the gains you’ve made because the investment is in a taxable account.

3) If you were to leave that money in the TFSA account and buy the same investment that you would have bought in the non registered account, your gain will be 100% tax free. No additional work required.

Hence, I see very little added benefit here and I would just leave the money in the registered account and invest in the 4%+ DGI portfolio. However, there is only one scenario that could be advantageous to you. Let’s say that the investment tanked and you lost 50% after five years. In this situation, you’ll be able to write off the losses against any capital gains that you have. This is not available to you if the investment is in your TFSA or RRSP.

I’m not sure if I would borrow money to invest, mostly because I don’t understand all the ins and outs. Luckily we have a great financial planner that helps us through what to invest and how to handle money to make it grow. I will be asking him about this!

@Megan, having a great financial planner to assist you with your investment is a smart option when you are not very familiar with the world of finance. However, in the long run, I’d recommend everyone to enhance their financial knowledge. You don’t have to be able to do everything, but having the knowledge to ask intelligent questions will serve you well in the long run.

I read through a lot of the comments and I read a lot of personal finance blogs. It seems like most people are deathly afraid of debt. I wouldn’t borrow money to invest in the stock market, but to buy cash flowing real estate…YES. Yes I would. I only have one property now but would like to add more. Leverage is powerful and makes your wealth grow a lot faster. Sure, there are risks but every investment has some risk. I think some people think it’s riskier than it really is. Make sure you purchase in a good location, get a good inspection, and a good property manager.

@Andrew, I do agree that with any types of investment, risk can be manage. For me I have both real estate and stock investments. I try to balance and both and have a 50/50 split.

Most of of the people are afraid of investing in market at all so, borrowing money and invest in market will be out of question… do you know why?…. mostly, because they are not financial educated.

Yes, I borrowed money to invest in market, real estate and more… and I am happy with the results. Sometime i feel that I should’ve borrowed more.

Two things to keep in mind, be organized and smart with your investments and do not borrow more then you can pay back… have a coverage for a period of 6-12 months (eventually create an emergency fund invested in GISs).

Great stuff Leo!!!

By the way, there are so many bloggers and people interested in investing in GTA… why not have a meeting sometime and share our experience???

@Cris, you are definitely right. I feel that some people are afraid to invest because they don’t want to take the time to learn how to invest. I strongly believe that it takes more hard work to be successful with your investment rather than with your superior brain power.

I am always open to meet and discuss ideas. If you or anyone interested, feel free to use the contact page to reach me.