Ever since I started to manage my own investments, I often captured a snapshot of my net worth every quarter of the year, just like how publicly traded companies report their quarterly earnings. At first, I was just obsessed with comparing my investment performance to the S&P/TSX Composite index and S&P 500 index as I invest in both the Canadian and U.S. stock markets. Whenever I outperformed both indexes on an annual basis, it really gave me a huge confidence boost and it kept me motivated to do even better the next year. However, I never really had anything to measure myself against except for the two stock market indexes. What was even worst was that I did not have any concrete financial goals in my life.

Figure #1: My 2016 performance review

Until recently, after I started blogging and reading other personal finance blogs, I realized that I was on a destination-less journey. By destination-less, I meant that I didn’t know how much money I will need when I retire, at what age can I retire and what my expected annually income will be when I retire. After a few months of research and self discovery, I was finally able to set some concrete financial goals for myself and I documented them in my Freedom 48 post. So going forward, I will be providing you (my stakeholders/readers) with a review of my financial performance every quarter and make myself accountable for those results and shared my journey with you.

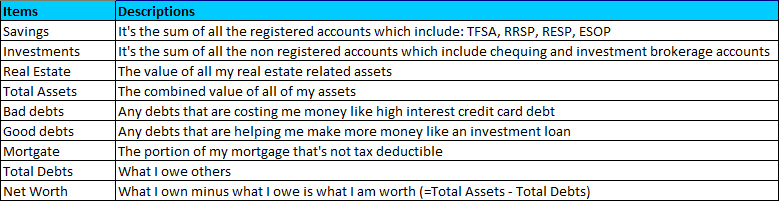

Figure #2: My financial breakdown descriptions

When providing the quarterly review, I don’t think it will provide any value to you if I just give you a table of what my net worth is now comparing it to what my net worth was at the same time last year (on second thought, I will provide a table as it will help me explain it better). To ensure that my readers get the most out of this post, I will reflect on my achievements (things that I did well) and failures (things that I didn’t do very well) so we can all learn from it. I will reflect on the following areas: savings, real estate, debts, investments and net worth.

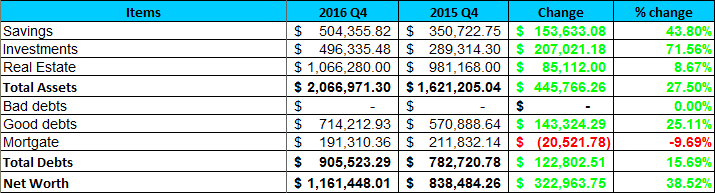

Figure #3: My 2016 net worth compared to 2015

Savings

Ever since I joined the workforce, my goals were to pay as little income taxes as I possibly can and to take advantage of free money when offered. If you had read my “how I love saving money” post, then you’ll know that I am quite the disciplined saver. So my current year’s Registered Retirement Savings Plan (RRSP) contribution limit was maximized mostly due to the participation of the Employee Share Ownership Plan (ESOP) through my employer and the annual year end bonus. This year’s Tax Free Savings Account (TFSA) contribution limit was also maximized and both of my kids’ Registered Education Savings Plan (RESP) government matching limit was maximized too. Based on these saving activities and the free money, my family’s savings amount to about $47,000 of the $153,633.08 increase over the previous year’s saving amount. The best part was $21,500 ($16,000 tax refunds, $4,500 ESOP matching, $1,000 RESP matching) of $47,000 was free money. Hopefully, you are motivated to save more when you see the amount of free money that you can get when you save. If you are interested to dig deeper into how I did it, you can find it here in my “72% return on my savings” post. Based on the results, I think this category deserves an exceed expectation rating.

Real Estate

If you have read anything related to the Canadian real estate market within the last two years, you will know that the Canadian real estate market is sizzling hot. As a home owner and a real estate investor who lives in the Greater Toronto Area (GTA), a sizzling hot real estate market is always welcome news. I took the opportunity to cash in some of the gains by selling the condo unit located at downtown Toronto that I co-owned with two other investors. Even with the liquidation of one of my investment units (I owned only 25% of that condo unit), the value of my real estate holdings still increased by $85,112. This increase is a reflection of a $100,000 increase in value of my principal home and a $10,000 deposit on a new construction condo unit. With this adjustment, the price of my home is still $75,000 under the bank’s appraised value when I refinanced my mortgage during this past spring and $150,000 under the price of recently sold homes around my neighborhood. When it comes to the value of my real estate holdings, my estimated value is usually at the cost of purchase or at least 10% under the current market value. This is to ensure that if I need to sell my holdings quickly, I am pretty sure that I can sell it confidently at that price (I also save some commissions too because I am a Realtor). Since I did not do much on this front and all the gains were due to the market condition, I’ll give this category a borderline meet expectation rating.

Debt

When I talk about debt with others, very often, I get a sense that most people associate debt with a very evil vibe and want to distance themselves as far away as possible or even trying to get rid of it. I am pretty sure that you heard of this cliche, “There are good debts and there are bad debts.” Just like there are good cholesterol and bad cholesterol. Just like cholesterol, you should increase the good debts and decrease the bad debts. Since I have very little to no bad debts, I have a lot more freedom and flexibility to increase my good debts. Earlier, I mentioned about the sizzling real estate market in the area that I live in, I took full advantage of it when my mortgage was up for renewal earlier this year. I refinanced it and borrowed an extra $200,000 at a fixed rate of 2.59% and locked it in with a five-year term. The access to new funds came in at a very opportunistic time as the Canadian stock market crashed last year. I was able to purchase some great dividend paying stocks at a decent discount and even getting paid on the new money that I borrowed. Based on my net worth table, $714,202.93 of $905,523.29 of my total debt are good debt as every penny that I paid in interest to service that debt, I get to legally deduct it from my income at the highest tax bracket. So part of the $16,000 in my family tax refunds was attributed to my debt management strategy. On top of it, every penny of the $714,202.93 is working hard for me. To cap it off, I locked in my loan at a reasonable rate as the banks raised their interest rates a couple of times after I locked in my mortgage. As a result, I am delighted to give an exceed expectation rating for this category.

Investments

Last year, the Canadian stock market lost about 11% overall and my investment portfolio took it on chin, losing a whopping 15%. Since I use margin to invest, naturally, my performance will be magnified either positively or negatively. In this case, the losses were magnified negatively and my stock portfolio lost about $100,000. When there’s blood on Bay street, there’s definitely opportunities to be taken. I used about $79,000 of the $200,000 from my mortgage refinance to purchase dividend paying stocks (I used some of the proceed to pay off loans and still have about $40,000 that I can put to good use in the new year). The market rebounded with vengeance this year, making an awesome 17.51% recovery. So did my stock portfolio, gaining a healthy 28.50% or $195,191.56 (in paper gains). Part of this gain can be attributed to the new money that I put to work and I wrote a few naked put options during the low price point of some stocks and covered call options during the high price point of other stocks in my portfolio. For now, of the seven options that I wrote, six of them will most likely expire worthless (free money for me) and I may have to buy one stock for the naked put option that I wrote (you can learn about options in this post). In terms of percentage gain, this year ranked only second to my best performing year in 2009 at 33.5%. In terms of dollar amount, this is by far the most I’ve ever made as I have built up quite a bit of assets comparing to previous years. Even with the stellar returns that I made this year, my stock portfolio is still far from ideal. I will need to do better in order to minimize the impact of negative return years on my net worth. When it comes to my investment portfolio, I am being quite tough on myself. So this category is only getting a meet expectation rating.

Net Worth

At this pace, my Freedom 48 dream may be accelerated to Freedom 45 or sooner. This is probably just only a dream as I know quite well that ever since I started investing in the stock market back in 2008, there were three years of negative returns of 11% or more in the Canadian stock market. It’s like you take two step forward and one step back. I tend to be more cautious when the market is exuberant. Anyway, I think I am getting off-track a little bit. Let’s get back on track shall we? The key thing that I want to emphasize in this section more than anything is a simple equation:

Net Worth = Total Assets – Total Debts

From this point of view, most people will point to the obvious: if we decrease Total Debts, then we’ll increase our Net Worth. This is totally true and there is nothing wrong with that. However, we can reformulate the equation to:

Net Worth + Total Debts = Total Assets

Now we have a different view on debt. We can either increase or decrease debt and still have an increased Net Worth. There is a caveat to this view. The rate of increase in Total Debts should be slower than the rate of increase for Total Assets in order to have a stable increase in your net worth. From my Net Worth table, you can see that my Total Debts, Total Assets and Net Worth are increasing at a rate of: 15.69%, 27.50% and 38.52% respectively. At the end of the day, there is no right or wrong way to look at this equation. The important thing to remember is to not restrict your money making strategy to just concentrate on just one variable or the other. Leave no stone un-turned. Since my net worth broke the million dollar mark this year, this category deserves an exceed expectation.

My overall performance for 2016

Overall, this year has been one of the most successful year that I ever had in terms of my personal finance. I was able to take advantage of the opportunity to borrow at a great rate when my mortgage was up for renewal and deployed the new money to work with great timing. I was able to set two major financial goals for myself, which were life changing. Most importantly, I discovered that blogging had provided me with an avenue to express my thoughts and provided me with a sense of fulfillment that no other work had ever provided me in my life. Based on all these mostly positive ratings and very little negative ratings, the overall performance rating for 2016 is a satisfying exceed expectation. Hopefully, I can maintain this performance for as long as I can.

My goals for 2017

I can’t end the year with no goals for next year. That will be irresponsible of me and no one will slap me around if I didn’t meet expectation next year. So here is my Freedom 48 goals for 2017:

1) Increase my net worth by 10% in 2017 ==> $1,277,344.86

2) Maximize the contributions to registered saving accounts for the family ==> $43,000

A) TFSA = $11,000

B) RESP = $5,000

C) RRSP = $17,000

3) Build a $10,000 family vacation fund

4) Give away $2,017 to my loyal followers during 2017

5) Generate $5,000 in revenue from my blogs

So how did you fair in 2016? What are your goals for 2017? Do you think that I am being too generous or too harsh with my performance review?

About Leo

About Leo

Sounds like you will definitely be hitting Freedom 45 if your portfolio rises by 28.5% and you see your net worth increase by almost 40%. Awesome job for the year and I have no doubt that you are going to crush your 10% net worth goal this year. I’m surprised that you didn’t say 10% each quarter 🙂

Hope you and your family have a great 2017!!!

Thanks for the well wishes MSM. I see that from your own year end review, you didn’t do too shabby either at healthy 34% return on your net worth and you didn’t even need to include your real estate gains. You’ll probably push pass the 40% mark if include that, but different people have different views and philosophies on how to calculate their net worth.

As for the 10% return per quarter, if I have that much confident in myself and I am able to realistically achieve that in the long run, I think that applying for a portfolio management position at a hedge fund will be a better choice for building wealth rather than writing this blog. However, my targeted 10% return is the long term compounded rate of return on an annual basis, which is slightly under the S&P 500’s 11+% annual compounded rate of return. If I am able to achieve the 10% rate of return for my investments in 2017, I’d consider that a relatively successful investment year.

Happy New Year to both you and your family too. See you in 2017.

What have you done differently in 2016 from 2015 that increased your net worth by almost 40%? Would you say you got lucky with the stock market doing well?

Hi FinNewbie,

I’d say that the increased in my net worth were due to several factors. The first was being able to refinance my mortgage so I have money so invest in the stock market when it was still relatively low. The second was the hot real estate market in the area that I lived in. The market increased about 25% year over year, which contributed to an increased of about $100,000 in the value of my principle home. The third factor was getting lucky in the stock market. After Donald Trump won the U.S. election, the stock market sky rocketed, which resulted in a 9.61% return for my investments for that quarter alone.

After gaining 28.5% on your investment for the year and you are only giving yourself a meet expectation rating, I am quite curious to know what percentage return do you need to achieve in order to have an exceed expectation rating?

The way that I assess my performance on my investment is not on the percentage return. I measure myself on how well I managed the volatility of my portfolio and the down side of the market. This is a risk management thing and I prefer to lower my investment risk as much as possible. For example, I’d not want to see another year with a paper loss of $100,000 again in the future if possible. Hence, it’s possible that my investment return can be -1% and I rate myself with an exceed expectation if the market loses 10% that year.

With the real estate market increasing at such a phenomenal rate, I wish I could of gotten in a little bit earlier, but I couldn’t find anything that fits my need yet. So my cash is just sitting in the savings account and earning peanuts of an interest rate. Hopefully, I can find something this year.

Congrats on the great performance, I wish that I can achieve the 10% return on my net worth this year too. I think it is a good number to aim for.

In my books, anytime when you can increase your net worth by 10% a year, that’s really good. Anything above that, it’s icing on the cake. So my long term goal is to achieve 10% return on an annual basis. We can do this.

Hello Leo

First time on your blog. I live in montreal Im 38 years old , Im new to stock investing. I just sold my rental property and have 80 000$ to invest. My primary residence is paid off. Any quick suggestion where to start? Is 38 old to get started?

@Stefano, welcome to the ISaved5K personal finance community. Congrats on being mortgage-free. At 38, you’re still young and have quite a few investing year in you and it’s never too late to start. Here are a few recommendations to get your started:

1) Basic Investment Concepts: this post will get introduce you to the investment concepts for beginners.

2) third step to saving a million dollars: this post talks about the power of compounding interest and investing in the stock market

3) How I earned an easy 72% return: this post shows you how I took advantage of free money. You can do it too.

There are other posts that you can checkout too. Just browse the archive. If you have any other questions, feel free to give me a shout.