Before attending my first business class in university, I had always known that if I make any income, I’d have to pay income tax to the Canadian government, but I did not know approximately how much I’d have to pay. I think that I am a law abiding citizen and I am getting free health benefits, so paying taxes is just a normality for the average citizen if income is earned. However, to my surprise, when I discovered the amount of taxes that I’ll have to pay once I reached a certain income level, every extra dollar that I earn, I’ll have to pay more than 53 cents to the government (it’s not very motivation to earn more if the government gets the bigger share of the earning than you do). From that point on, I started to understand the true meaning of: “It’s not how much you make. It’s how much you get to keep.” And keeping more of every dollar that I earned through tax saving strategies was wired into my investment strategies. In this post, I’ll demonstrate the different tax strategies that I use to pay less taxes. Legally.

Income Tax Basics

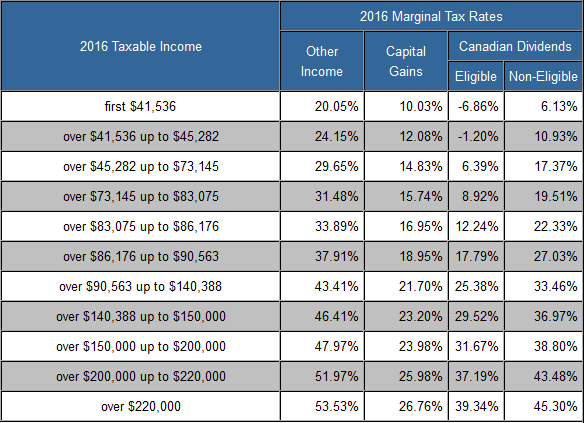

In order to find a strategy that will allow you to pay the least amount of taxes, you’ll have to know your income tax bracket. A really good tax resource that I use find my marginal tax rate for personal income, interest, dividend and capital gain income is the TaxTips website. This website shows you the breakdown of all the tax brackets for all income levels for all Canadian provinces. For example, I live in the province of Ontario, the table below showed that for the first six income tax brackets, from $0 to $90,563 of income earned, the most efficient form of income is Canadian dividend income (you pay the least amount of taxes for this form of income.) For me, I am in the seventh tax bracket (43.41%) and the most efficient form of income is capital gains. Hence, I’ll structure my tax strategy around the capital gain income to reduce my taxes.

Sourced from TaxTips: Ontario Marginal Tax Rates

Net Capital Gain and Capital Loss Basics

When you incurred a net capital loss for any income tax year, those net capital loss can be carried forward indefinitely into future tax years, until you have a net capital gain. You can offset the carried forward net capital losses with the net capital gain for any future years that you incur a net capital gain. For example, if I incurred a net capital loss of $5,000 this year, I can offset $5,000 of net capital gain from any future tax year after 2016. Furthermore, for any net capital losses incurred this tax year, you’ll be able to offset it from the net capital gains from any of the three preceding tax years (e.g. 2015, 2014 and 2013).

Tax Loss Selling

Tax loss selling is a popular investment strategy that investors used to lower their current year’s capital gain and pay less income taxes. For example, I sold a few naked put and covered call options this year and had incurred about $3,000 of capital gains through the premium that I collected (here is my option strategy post). To offset the capital gain, I can choose any loser stocks in my non-registered account and sell it to realize the capital losses.

Tax Loss Selling Rules

To fully meet the tax loss selling rule set by the government, the transaction will have to settle before the end of this year. It takes three business days for stock transactions to settle in Canada and the U.S., so the last day to execute your tax loss selling are December 23, 2016, for Canadian stocks and December 26, 2016, for U.S. stocks. In addition, you cannot buy the same stock in any of your registered or non-registered accounts within 30 days of selling your loser stock. Otherwise, you won’t meet the tax loss selling rule, even if the transactions were executed during different years.

The Switch Strategy

For those investors that have a limited number of stocks in their portfolio and don’t want to exit an industry, they can use the switch strategy. For example, if I bought 100 shares of Rogers Communication Inc. (RCI.B) common stocks at $58 per share during August 2016 in my non-registered investment account and now it’s trading at about $51 per share, I can sell the RCI.B common stocks now to realize the capital loss. After selling the RCI.B common stocks I can use the proceed of that sale and purchase either BCE Inc. or Telus Corporation common stocks. By switching from one Telecommunication company to another, I locked in the capital loss to offset my capital gain and still have maintained the same investment portfolio weighting with minimal changes.

The Transfer Strategy

Another tax-saving strategy is to transfer the holding of the loser stock from your registered account to your non-registered account if you still want to own the loser stock. Once again, let’s use the RCI.B common stock as an example. Let’ assume that I bought it at the same time and price, but this time the RCI.B common stock was bought in my RRSP account. I can sell the RCI.B common stocks in my RRSP account and buy it back in either my TFSA or non-registered account. By doing this, I still own the stock but will pay less taxes in the future. For example, let’s assume that in 10 years RCI.B appreciate to $100 per share. If I bought it back in my TFSA, the 10 years of dividends that I collected from RCI.B and the capital gain from $51 to $100 is tax-free. On the other hand, if I bought it back in the non-registered account, I’ll only pay about 25.38% in income tax for the dividends and only 50% of the capital gain from $51 to $100 is taxed. Comparing to the case that I did nothing and left the stock inside my RRSP account, if I withdraw money my RRSP account, the dividend and capital gain from $58 to $100, will all be taxed as regular income. Hence, this an effective way to pay no tax or less for your investment gains in the future, but you don’t get the benefit of the tax loss for the current year. Still, I think the trade-off is definitely worth looking into if you have the flexibility free cash to move your investment around.

My two cents

When you are trying to accumulate asset and build your net worth, it’s important that you get to keep more of the money that you make so you can deploy that money to make even more money. This is a form of compounding that will pay off handsomely as time goes by. Hence, knowing what action you can take to minimize your income tax for the current or future year, will allow you to use the extra cash that you save to work harder for you instead of the government. So, for your income tax, know the rules well, play within it and use it to your advantage.

What tax rule do you use to keep more of your money?

About Leo

About Leo

Here in the US I try to maximize my 401k in order to save as much as possible now and grow it tax free while deferring my taxes until later. While I’m not hopeful that taxes will decrease significantly in my lifetime it is nice knowing that my investments are growing tax free in the meantime.

I had no idea how progressive Canada’s tax rates are, I can’t imagine having to pay 53%. Do you also have to pay a providence tax?

Hi MSM,

The 53% does include both the province and federal tax. I just can’t image the uproars of the high earners if the 53% only include the federal tax and there is another 10% to 20% on top of that for the province. I would just refuse to do anymore work after I hit a certain income. The diminishing marginal return is pretty much resemble my motivation. On the flip side of the coin, if you can find ways to get deductions to lower your income, you’ll get a lot more in tax refunds. Lazy people like me will try to find a way to harness it.

Question: if I own a small business and make $100 in revenue, what type of “investment” is considered as tax deductible? For example, can I invest in another business, or buying a property, etc? Also, if I were to buy life insurance for myself under my company, is that tax deductible as well?

Hi Kh,

To answer you first question, investments are not tax deductible for business nor for personal income tax purposes as far as I know. However, if you purchase assets such as a computer, a car or even furniture for business purposes and it helps your business earn income, you can depreciate a certain percentage of those asset on an annually basis. To know the depreciation for each asset class, check the Canadian Revenue Agency’s website for the Capital Cost Allowance rule. It’s also better to check with your accountant as I am not qualified to provide tax advice.

For your second and questions, without knowing your financial background, your personal balance sheet it will be difficult for me to comment on what option is more efficient. In addition, I am not qualified to give out investment advice. If you want to know a complete list of what is tax deductible, check out the TaxTips website, they list all the deductions that are available to Canadians.

Have you ever considered using life insurance to shelter your investment gains? I heard a lot of wealthy people use this strategy to minimize future or estate taxes.

I do have a Universal life insurance policy and had an investment component when I first bought my policy. However, after I learned how to invest for myself, I prefer to be able to see where my money is being invested and how much fees that I am being charge. I was not satisfied with in information provided by the annual statement, so I decided to stop the investment component and just kept the insurance policy.

Wow, that income tax table is eye opening. It doesn’t seem very motivating to earn more after a certain income level when you are keeping less than what the government takes for every extra dollar earned.

Great strategies… this is where I feel It is wayyy over my head. but I appreciate your explanations. We use an investment advisor so I think I have a few questions for him after reading this blog article. Cheers.

Lori, there is nothing wrong with working with an advisor. You don’t have to know all the ins and outs of every financial concept. So asking the right questions is key when you are getting help from others.

Interesting article. If planning to make a good chunk of money in your career, you must also come up with a plan to lower your taxes paid. As you stated, the more you make, the more you pay and at some point it becomes that you penalize yourself by making too much money if you don’t have a way to lower the taxes paid.

E.M., That’s the exact thought that I had when I first started my career. Even though I did not make a lot, I tried to keep as much as I could. In my opinion, the RRSP is one of the best saving vehicles out there for Canadians. Especially if you are on the higher tax brackets. It does pay to know the tax rules.

This is a memo to the admin. I came to your Freedom 48 Investment Toolkit: Minimizing Your Income Tax – I Saved $5K page by searching on Google but it was difficult to find as you were not on the first page of search results. I know you could have more traffic to your site. I have found a company which offers to dramatically improve your website rankings and traffic to your site: http://korturl.no/1tg1z} I managed to get close to 500 visitors/day using their services, you could also get many more targeted visitors from Google than you have now. Their services brought significantly more visitors to my website. I hope this helps!

I decided to leave a message here on your Freedom 48 Investment Toolkit: Minimizing Your Income Tax – I Saved $5K page instead of calling you. Do you need more likes for your Facebook Fan Page? The more people that LIKE your website and fanpage on Facebook, the more credibility you will have with new visitors. It works the same for Twitter, Instagram and Youtube. When people visit your page and see that you have a lot of followers, they now want to follow you too. They too want to know what all the hype is and why all those people are following you. Get some free likes, followers, and views just for trying this service I found: http://c.or.at/26h

This was a great suggestion to minimize your income tax, however, this guideline is really good for me. Thank you for the share, Leo.

@Sharon, I am glad that this post is useful to you. If we can legally pay less taxes by saving money, why not? I would love to keep as much of my hard earn money as I can. Hopefully, you can keep more of your money after reading this post.

Hello there, Leo, you have a awesome post, definitely some great tips, and advice! Sometimes it can get confusing and complicated to do your taxes on your own or you may not have the time.