When it comes to emergency funds, how much should you save? Depending on who you talk to, different people have different philosophies. Some will say three months of expense is sufficient, some will say six months, while other more conservative minded will recommend twelve months.

Regardless of the amount, there are no right or wrong answers. The bottom line is, when an emergency hits, the most important thing is having access to and enough funds to cover the emergency at hand, not the value of your emergency fund account. Below are the five methods that I use to assure that I have quick access to funds on short notice when emergency hits.

Home Equity Line Of Credit (HELOC)

This is a line of credit that is secured against your home provided that you have at least 20% of equity in your home. This line of credit grows as you pay down the principle of your mortgage. You can have access of up to 65% of the value of your property if you pay off your mortgage. This form of borrowing is usually the cheapest as the interest rate is very close to the prime rate (the interest rate that financial institutions offer their best customers).

Unsecured Line Of Credit

This line of credit is not secured to any assets that you own. However, if you have more assets, it’ll give you access to a larger borrowing limit. The available limit of the line of credit is determined by your net worth, income and credit history. The interest rate for this type of loan is usually 0.25% to 1% above the HELOC. Still, a very cheap way to borrow.

Margin Account

When you open a non-registered investment account at your investment broker, you can ask for a margin account. This type of account allows you to borrow up to 50% of the assets’ value in the account. The amount that you can borrow is determined by the type of investments that you own in your account. The riskier the assets that you own, the lower the amount of funds will be available for you to borrow.

The other factors that affect your ability to borrow from this account are the product and services that you bundled with your financial institution, your income and credit history. You can get borrowing rates that are as good as an unsecured line of credit if you are one of the preferred clients or at slightly higher rates of 0.25% to 0.75%. Not too shabby eh?

Credit Card

Most of the credit cards out there in the market have an interest rate of at least 19.9% per year. However, I did find a few low interest rate credit cards at about 5.99% to 11.99%. Not be best borrowing rate in the world, but better than most of the credit cards out there.

Since I am only using this card as a last resort for my emergency fund and I’ve absolutely exhausted the first three options, this will be my next option. Every percent that I can save, counts.

Overdraft Limit

Most banks offer overdraft protection to their clients on their chequing account. The bank’s pitch is, “If you accidentally take more money out of your account than the amount of money that you have in there, you won’t be charged a $25 Non-Sufficient Funds (NSF) fee if you have overdraft protection.” You can get up to $5,000 in overdraft limit for each of your chequing account.

However, when you find out the fees that you’ll be paying it’ll be worst than the low-interest-rate credit cards. For starters, you’ll be charged $5 per month that your account is in overdraft. The interest rate that you pay amounts to 19% per year. This type of access to funds will never garner any interest from me.

Pay day loans

I don’t want to go into too many details about this, but this type of loan is pretty much like borrowing from a loan shark. I’ll never go into one of these places to borrow money. Enough said.

My two cents

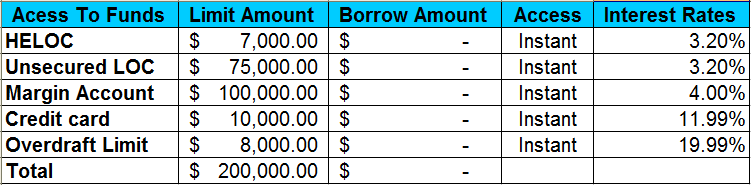

My view on the amount of emergency funds that you should save is quite contrary to most of the so call personal finance experts out there. First of all, I don’t believe in emergency funds. I believe in access to funds (with the five items mentioned above, I have instant access to over $100,000 if I need it for an emergency, see the table below). The argument is, “my emergency funds should work harder than me. So sitting there in a savings account and earning peanuts of an interest rate and I also have to pay tax at the highest tax bracket for the interest earned, does not make sense.”

If I have an emergency fund of $20,000 and I still have a mortgage, I would put that amount towards paying down my mortgage. This way, I would earn a higher return on my saving, pay no taxes on the interest that I’ll save from my mortgage interest and I’ll have access to that $20,000 anytime I want as I have an HELOC when I set up my mortgage. When it comes to my money, it should work harder so I don’t have to (I wonder if I can apply the same philosophy to my kids one day?).

So, how much emergency fund is sufficient for your needs?

About Leo

About Leo

What a great way to build up access to funds when you need it and not having to lock up your money in your savings accounts. If you were to lose your job, how likely are you able to maintain access to these funds?

– Ralphael

Hi Raphael,

Great question. Let’s review each of the items to see what the risks are:

HELOC – As long as you are paying your mortgage and it’s in good standing, I don’t think the bank is going to close your HELOC even if you lose your job. So the risk is minimal

Unsecured LOC – Normally, financial institutions don’t suddenly review your loan if you keep paying your bills and they are not overdue. Your change of employment status won’t be updated unless you tell them or they run a credit check. They don’t do a credit check for without your approval. Once again, the risk is minimal.

Margin Account – Once you get the margin account opened and your buying power is positive, your broker won’t care. The only risk is the decreased in value of your assets in the account.

Overdraft Limit – This limit is a small amount and they won’t revoke it unless you don’t pay your bills and maxed out all of your loans. Only risk is not paying your bills.

Credit Card – As long as you pay your bills on time, you are safe.

Interesting method to build access to an emergency fund. I guess that at the end of the day, when craps happened, the money is coming out of your pocket anyway, it would not matter which account it came from anyway. Great job for building such a huge cushion for yourself.

Exactly. You seemed to read my mind. Since I have access to a decent amount of money, I can use my emergency fund to work harder for me. I don’t own bonds in my investment portfolio at all and for sure, I am not going to have my money sitting in a saving account and earn peanuts.

Essentially, you lay out a number of loan options that you can establish prior to the emergency. Where do these options stand w.r.t. selling assets to cover all or part of the emergency needs? In some cases, if the asset has lost value you can sell & offset taxes with capital losses. I would evaluate my portfolio for losers & sell them before I chose any of the options you laid out.

Great question Dan. For small emergencies of $5,000 or less, I don’t think I’ll have any issue covering it. For medium emergencies between $5,000 and $20,000 I’ll evaluate my options at the time of the emergencies. If there are opportunities/advantages for me to liquidate my assets and use the proceed to pay for the emergency, then I won’t hesitate to proceed. For major emergencies, more than $20,000 (I hope it will never occur), then I guess I’ll have to do whatever it takes. Sh!ts happened sometimes, so you just gotta deal with it.

Taking the credit card idea further, I have accumulated an inventory of cards that offer balance transfer offers of as low as 1% (0% + 1% balance transfer fee) for as long as 12 months. With the large inventory I have, there is almost always something available. With this, I have access to lots of $.

Even if I do not need the money, I borrow the funds and place them in a high interest savings account, and actually make some $ off the borrowed money (and the interest paid is tax deductible), thereby always making sure the funds are accessible (you will want to review CDIC rules to stay within insured limits).

@Smayer97, with lots of credit cards that are offering a balance transfer cost of 1%, you can literally lower your borrowing cost to about 1% per year. I did give some consideration for this, but I’ve never tried it because I don’t carry a balance on my cards. One of the fear that I have is forgetting to pay off the card in one year’s time and this mistake can be quite costly.

I can definitely see the arbitrage opportunity in your maneuver, but you will have to borrow a significant amount of money in order to make the earnings worthwhile. It seems like we have a very similar view on good debt and are willing to take calculated risks to increase our wealth. I would love to exchange more ideas with you to see how we can further use our good debts.

Lots of ways to track when final re-payment is due…automated reminder on calendar, in personal financial software, etc. I use Quicken to set reminders, along with all my other bills. BTW, I never carry balances on credit cards…and yes I adhere to the good debt/bad debt approach. Be glad to exchange ideas…though from the limited perusal of what I have seen on your site, you seem to have it well covered.

To be clear, though I do manage to move significant $ at times with this arbitrage maneuver, the bigger goal is keeping the funds easily accessible for when I do need them, while still getting paid in the holding/waiting period for an opportunity.